Allstate, State Farm Also Agree to End Restrictions on Sales of New Auto Policies

Los Angeles, CA – Challenges by Consumer Watchdog to double-digit auto and homeowners insurance rate hikes requested by State Farm, Allstate, Pacific Specialty, and GEICO that were resolved in the last two months resulted in total savings of $884.8 million for California policyholders. Additionally, also in response to requests by Consumer Watchdog, Allstate and State Farm agreed to lift restrictions on sales of new auto policies that the companies had implemented in 2022. And Pacific Specialty agreed to stop using “neighborhood pride of ownership” as an excuse to deny homeowners coverage. The six companies’ newly-approved rates will take effect between February and April 2024 and will impact over 9 million policyholders.

According to Consumer Watchdog’s analysis of the rate filings, the auto and homeowners insurance companies were overstating projected losses and inflation trends, causing their proposed rates to be excessive by millions of dollars. In each case, Consumer Watchdog successfully advocated for lower overall rate increases under Prop 103 and prior approval rate regulations that require insurers to justify all rate changes prior to implementation.

“California’s insurance market is in upheaval—insurance companies have created shortages by limiting sales of new policies across the state while at the same time pressing the Insurance Commissioner for massive premium increases,” stated Pamela Pressley, Consumer Watchdog Senior Attorney. “With mounting pressure on the Commissioner by insurance companies to swiftly approve insurance companies’ requested rate hikes, close scrutiny of rate requests and consumer participation in a public, data driven review process is more important than ever.”

The $884.8 million in savings for the six rate applications that the Commissioner approved in November/December 2023 was calculated by comparing the companies’ initial requests with the final amount approved:

| Company/Line of Insurance | % Rate Increase Requested | % Rate Increase Approved | $ Savings | Date Approved | Effective Date |

| GEICO Auto | 20.8% | 12.8% | 356 mill | 12/28/23 | 4/30/24 |

| State Farm Homeowners/ Renters/Condo | 28.1% | 20% | 199.7 mill | 12/22/23 | 3/15/24 |

| State Farm Auto | 24.6% | 21% | 152 mill | 12/22/23 | 2/26/24 |

| Pacific Specialty Homeowners | 6.9% | 3% | 6.3 mill | 12/21/23 | Within 120 days |

| Allstate Auto | 35% | 30% | 149.5 mill | 12/8/23 | 2/7/24 |

| State Farm Rental Dwelling Owners | 20% | 11.43% | 21.5 mill | 11/17/23 | 2/1/24 |

Under Proposition 103, insurance companies are required to obtain the Insurance Commissioner’s permission before they can increase premiums. Each insurance company must open its books to public scrutiny and prove that it needs the requested amount before the Commissioner may approve it. And consumers have the independent right to challenge requests that they believe are unjustified. After reviewing the requests, Consumer Watchdog invoked that power to challenge the six companies and worked to reduce the requests to fair levels.

Here is a brief summary of each of the challenges brought by Consumer Watchdog:

State Farm Auto

- Issues Raised by Consumer Watchdog: (Read Petition (opens in new tab))

- State Farm overstated projected claims payments, resulting in inflated rate increase requests.

- The company used a method for projecting Bodily Injury and Uninsured Motorist claims that would have resulted in excessive rates for Bodily Injury and Uninsured Motorist coverages.

- State Farm failed to exclude expenses from its rate calculation for institutional advertising (ads designed to improve the company’s image rather than selling specific insurance products), as required under state rules.

- Rate Requested by State Farm: 24.6%

- Stipulated Rate: 21% (Read Stipulation (opens in new tab))

- Savings: $152,005,591

- Additional Settlement Terms Achieved:

- State Farm agreed to a 6-month moratorium on when future rate increases can go into effect.

- State Farm agreed to resume online quoting as of 2/26/24.

State Farm Homeowners, Condo Owners, Renters

- Issues Raised by Consumer Watchdog (Read Petition (opens in new tab))

- State Farm’s 2021 net income of $436 million (more than 20% of premium) was inconsistent with its requested rate increase (28.1%).

- State Farm failed to justify what appeared to be an inflated projection in the rate calculation for catastrophe losses.

- State Farm made unsupported projections for claims payments for fire losses following an earthquake.

- State Farm overstated projections of claims payments, which resulted in an inflated rate increase request.

- State Farm failed to exclude expenses from its rate calculation for institutional advertising (ads designed to improve the company’s image rather than selling specific insurance products), as required under state rules

- State Farm failed to justify its request for a “variance” from the standard Proposition 103 ratemaking formula.

- Rate Requested by SF: 28.1%

- Stipulated Rate: 20% (20.8% for homeowners, 20% for condo owners, 0% for renters) (Read Stipulation (opens in new tab))

- Savings: $199,747,670

- Additional Settlement Terms Achieved:

- 6-month moratorium on effective dates for future rate increases

- State Farm will only use underwriting guidelines that have been publicly filed with CDI and will file complete underwriting guidelines contemporaneously with all rate and rule applications

State Farm Rental Dwelling Owners

- Issues Raised by Consumer Watchdog (Read Petition (opens in new tab))

- State Farm’s 2021 net income of $42 million (more than 20% of premium) was inconsistent with the large rate increase being sought (20%).

- State Farm made unsupported projections for claims payments for fire losses following an earthquake.

- State Farm overstated projected claims payments, resulting in an inflated rate increase request.

- State Farm failed to exclude expenses from its rate calculation for institutional advertising (ads designed to improve the company’s image rather than selling specific insurance products), as required under state rules.

- Rate Requested by SF: 20%

- Stipulated Rate: 11.43% (Read Stipulation (opens in new tab))

- Savings: $21,509,293

- Additional Settlement Terms Achieved:

- State Farm will only use underwriting guidelines that have been publicly filed with CDI and will file complete underwriting guidelines contemporaneously with all rate and rule applications

Allstate Auto

- Issues Raised by Consumer Watchdog: (Read Petition (opens in new tab))

- Allstate overstated projected claims payments and related costs, resulting in inflated rate increase requests.

- Allstate failed to exclude expenses from its rate calculation for institutional advertising (ads designed to improve the company’s image rather than selling specific insurance products), as required under state rules.

- Allstate took unilateral steps to limit access to its auto insurance products, including changes that violate Prop 103’s Good Driver requirements.

- Rate Requested by Allstate: 35%

- Stipulated Rate: 30% (Read Stipulation (opens in new tab))

- Savings: $149,524,877

- Additional Settlement Terms Achieved:

- 6-month moratorium on effective dates for future rate increases

- Resuming of online quoting and binding of policies as of 2/7/24

- Conforming of payment plan options to be the same for both new and renewal business, in order to comply with Prop 103 Good Driver requirements

Pacific Specialty Homeowners

- Issues Raised by Consumer Watchdog (Read Petition (opens in new tab))

- Pacific Specialty’s underwriting profit of $14.9 million and claims payments to premium ratio of 34.3% in 2019 was inconsistent with the requested rate increase.

- The company’s projections using a computer model for fire losses following an earthquake were 250% larger than another similar model, suggesting one of the models was unreliable.

- Pacific Specialty overstated projected claims payments, resulting in an inflated rate increase request.

- Pacific Specialty failed to support its request for a variance from the standard ratemaking formula.

- Pacific Specialty failed to use objective, non-discriminatory underwriting guidelines by refusing to insure properties located in neighborhoods not showing “pride of ownership.”

- Rate Requested by Pacific Specialty: 6.9%

- Stipulated Rate: 3% (Read Stipulation (opens in new tab))

- Savings: $6,334,736

- Additional Settlement Term Achieved:

- Removal of underwriting guideline denying coverage for “Properties located in a neighborhood not showing pride of ownership or condemned dwellings”

GEICO Auto

- Issues Raised by Consumer Watchdog (Read Petition (opens in new tab))

- GEICO overstated its projected claims payments, resulting in inflated rate increase request.

- GEICO failed to exclude expenses from its rate calculation for institutional advertising (ads designed to improve the company’s image rather than selling specific insurance products), as required under state rules.

- GEICO was including excessive expenses in the rate calculation by claiming 25% of its expenses were attributable to sales through agents, even though all GEICO sales offices in California were closed in 2022 and it now only sells policies directly through in-house employees over the phone or internet.

- GEICO’s use of education and occupation as rating factors to charge lower income workers more for an auto policy than professionals with advanced degrees violates Prop 103 and the auto rating factor regulations.

- Rate Requested by GEICO: 20.8%

- Stipulated Rate: 12.8% (Read Stipulation (opens in new tab))

- Savings: $356,008,006

- Additional Settlement Terms Achieved:

- 6-month moratorium on effective dates for future rate increases

Consumer Watchdog is presently challenging 2024 homeowners insurance rate increase requests by Allstate (39.6%), Liberty Insurance Corp. (29.1%), Standard Fire Insurance Company (21.7%), and USAA (20.2%), and a 28% rate increase sought by CSAA’s to its auto insurance policies. Among other issues, Consumer Watchdog’s petitions allege that the companies are overstating their expected claims payments, resulting in inflated rate requests.

Background

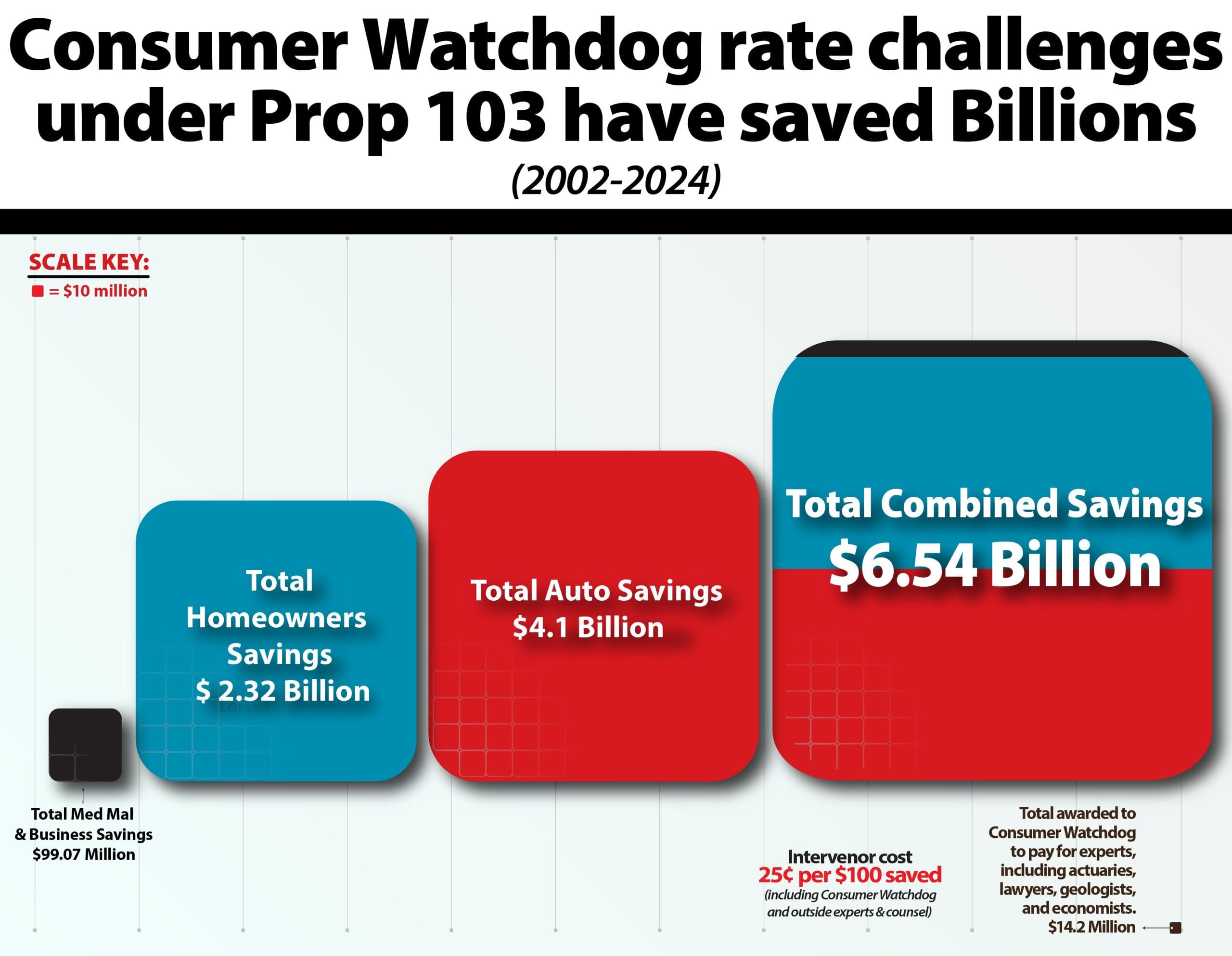

A 2019 study of the nation’s insurance laws, the Washington, D.C. based Consumer Federation of America called Proposition 103 “the best in the nation” and calculated it had saved Californians $153 billion on their auto insurance premiums alone… while allowing insurance companies to earn fair profits. Read CFA analysis here.

Founded in 1985, Consumer Watchdog is a non-profit, non-partisan organization.