Los Angeles, CA — Consumer Watchdog issued the following statement about Commissioner Lara’s action today threatening consumers’ voice in insurance rate review.

“For the past two months Consumer Watchdog has shared with state lawmakers our concerns that the budget trailer bill proposed by Governor Newsom and Insurance Commissioner Lara would cut the public out of insurance rate review and cost consumers billions of dollars. The Commissioner’s abrupt action today to abandon the bill in favor of unilateral executive action makes clear those concerns were gaining traction,” said Carmen Balber, executive director of Consumer Watchdog. “However, we remain concerned that the new procedures announced by the Commissioner will short-circuit public participation and rates will be rubber-stamped.”

Today’s bulletin mirrors provisions of the withdrawn budget trailer bill that would:

- Curtail consumers’ voice in rate increases below 7% by preventing the public from meaningfully participating before a rate increase is approved

- Require the insurance commissioner to make rate decisions based on incomplete information

- Encourage insurers to apply for three 7% rate hikes a year to avoid public hearings

“Consumer Watchdog will analyze this action to determine if it is an illegal underground regulation or otherwise violates Proposition 103 by shutting consumers out of the process,” said Balber.

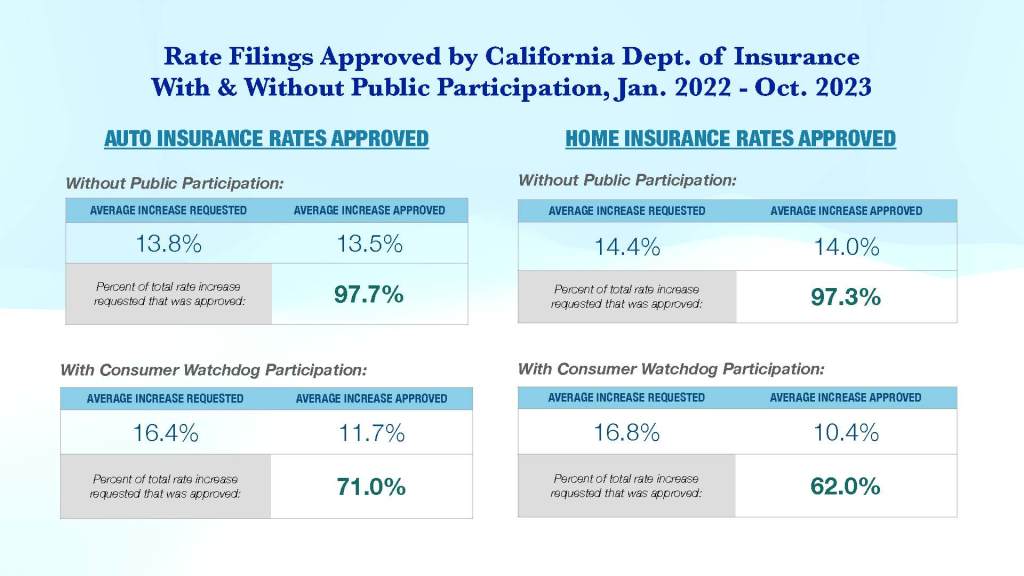

The public intervenor process results in significant savings for consumers. A review of home insurance rates approved in 2022 and 2023 shows that when the commissioner reviewed rates on his own, insurance companies got on average 97% of the rate increase they sought. When Consumer Watchdog participated, home insurance companies received on average 62% of the increase they requested.

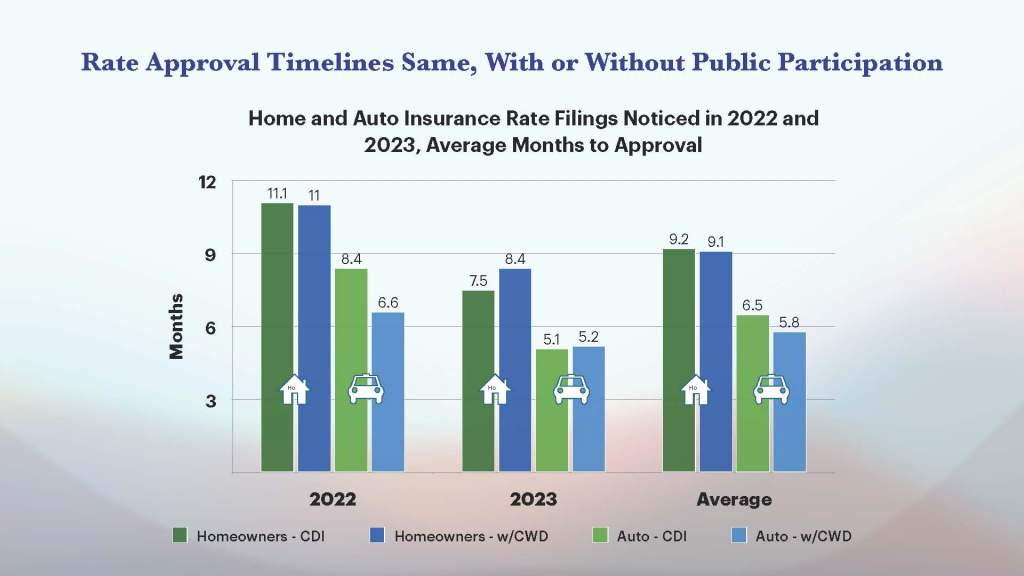

Consumer Watchdog endorsed timely rate review and said it need not come at the expense of public participation. A review of rate approvals in 2022 and 2023 shows that intervenors do not slow the process down. The average approval time for home insurance rates was the same in 2022-23 whether Consumer Watchdog participated, or the commissioner acted on his own.

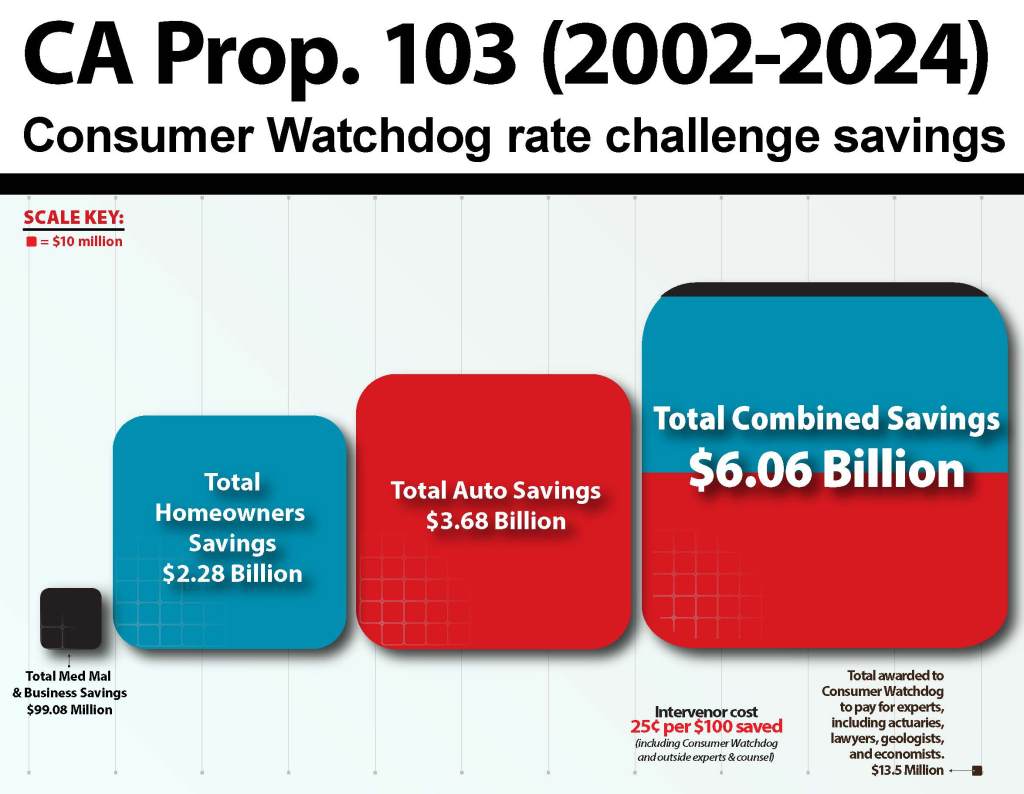

Consumer Watchdog rate challenges over two decades, 2002-2024, have resulted in $6 billion in savings for consumers. More than half of these challenges involved rate increase requests below 7% which are targeted by the bulletin.

Read the letter six consumer groups sent to the governor and legislative leaders opposing the trailer bill and a chart showing problems with the trailer bill and amendments proposed by Consumer Watchdog.

Read the study, “How Citizen Enforcement of Proposition 103 has Saved Californians $5.5 Billion – and Why the Insurance Industry Hates It,” for more information about how the public intervenor process gives consumers a voice in rate review and saves consumers money.