It should have been proforma, but Insurance Commissioner Ricardo Lara has finally certified Consumer Watchdog’s right to collect compensation for intervening in insurance rate cases.

The only real criteria was whether Consumer Watchdog represents the interests of consumers, but, in an unprecedented move, Lara threw that open to comments from the insurance industry. Insurance companies came in hot and heavy claiming we saved consumers too much money ($6 billion over the last 22 years in averted rate hikes) and that discouraged them from participating in the market.

Truth is insurance companies have made greater returns in California, by every measure, over the last 20 years, and in the last four years, than they have nationally. They are simply zeroing in on a weak insurance commissioner to achieve deregulation and higher rates.

In the end, Lara had no choice but to approve our intervenor status. We would have taken him to court.

In his hostile response, Lara said, “Even with the additional information, it is unclear what work Consumer Watchdog actually performed in the rate application process versus that of the Department.”

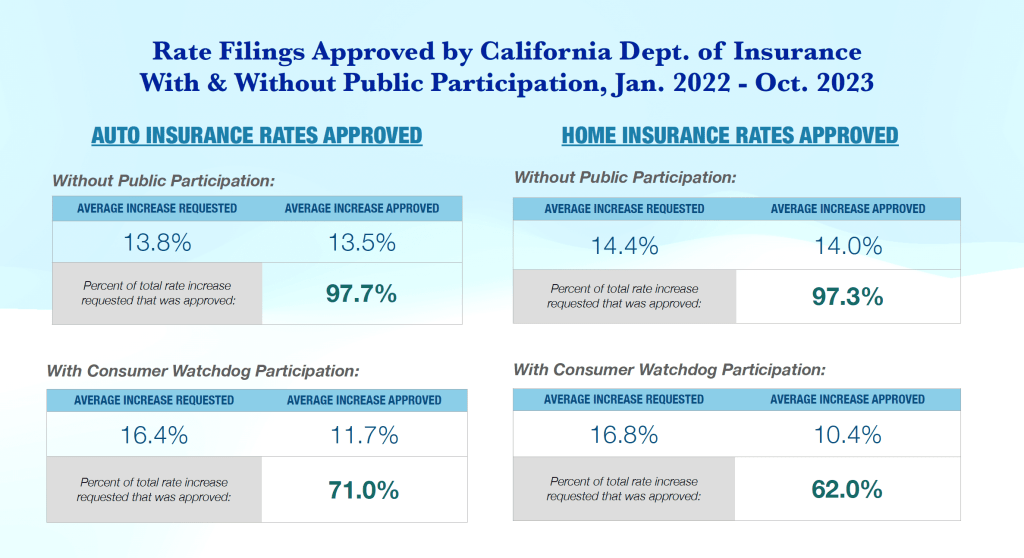

The numbers are pretty clear on that point, however.

When the Department is the only one involved in a rate decision, it approved 97% of the rate requested in homeowners insurance cases. When we are involved as an intervenor, insurance companies only get 62% of the rate they requested in homeowners insurance cases.

For auto insurance cases, companies got 71% of the rate requested when Consumer Watchdog intervened and 97% of the rate when it was just the Department.

Over the last 10 months Consumer Watchdog saved consumers nearly $1.5 billion in averted rate hikes. Consumer Watchdog needs to be in the rate review process to save consumers from unjustified rates.