Los Angeles, CA – The top two publicly-traded companies selling black box catastrophe models to insurance companies have financial conflicts of interest that should bar their use in California to set rates, Consumer Watchdog will testify at a California Department of Insurance hearing today.

Insurance Commissioner Ricardo Lara will hold a workshop this afternoon at 1pm to discuss the use of algorithms and AI models in California, which is presently barred for most forms of insurance.

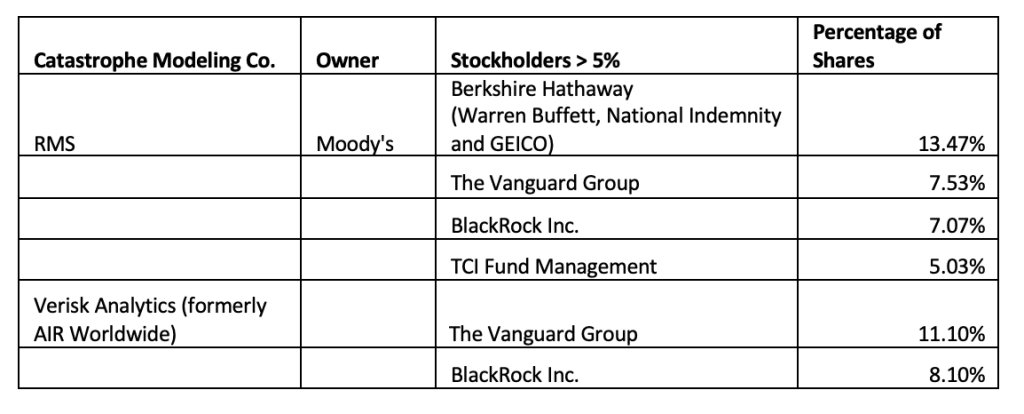

Top catastrophe modeler RMS is owned by insurance ratings firm Moody’s. The largest shareholder of Moody’s RMS is Berkshire Hathaway, through the Warren Buffet-owned insurance companies National Indemnity Co. and GEICO. Wall Street financial services companies The Vanguard Group and BlackRock Inc., which manage hundreds of billions in assets for insurance clients, are the top shareholders in the other modelling industry giant, Verisk Analytics. Vanguard and BlackRock are also the second and third largest shareholders of Moody’s. Both RMS and Verisk have lobbied to get Insurance Commissioner Lara to allow the use of secret catastrophe models to set rates.

These conflicts create powerful financial incentives to use the modelers’ undisclosed climate algorithms to artificially inflate insurance rates, said Consumer Watchdog.

Insurance Commissioner Ricardo Lara announced a deal with the insurance industry last week to fast-track new rules allowing insurance companies to use catastrophe models to determine how much homeowners, renters and condo owners will pay for home insurance.

Any model used in California must be fully transparent, with the model and algorithms made available to the public for testing and review, said Consumer Watchdog.

“We know that insurers make more money when black box models artificially inflate rates. Now it’s clear that the shareholders of those Wall Street catastrophe modelers also benefit fincancially when models push rates too high,” said Carmen Balber, executive director of Consumer Watchdog. “Modelers with conflicts should be barred from California’s market, and any model used to set rates must be fully transparent under insurance reform Proposition 103. The best way to ensure that is to build a public model in California that the public and insurance companies can access equally.”

Catastrophe Model Top Investors

View RMS and Verisk shareholder proxy statements with shareholder disclosures.

Insurer and Wall Street ownership of the publicly-traded catastrophe modelling companies raises multiple financial conflicts.

- Wall Street financial firms The Vanguard Group and BlackRock Inc. are the largest investors in Verisk Analytics and the second and third-largest investors in RMS. Vanguard and BlackRock make their money by managing clients’ investments and handle billions in insurance industry assets. BlackRock reports managing $403 billion in general account assets on behalf of insurance companies and “has a dedicated team of insurance portfolio managers, relationships managers, actuaries, and strategies to deliver the breadth of BlackRock’s global resources.” Vanguard’s asset management for insurance accounts site touts its “deep industry knowledge and 19 NAIC-rated fixed income ETFs” … “We’re well suited to help insurers, whether your needs are short or long term.” The companies’ management fees will increase if insurers’ investable revenue increases because the RMS and Verisk models recommend excessive premium increases.

- Insurers also have reason to back private models to stay in the good graces of Vanguard and BlackRock, which manage extensive investment portfolios from pensions and other industries that can be directed towards, or away from, the insurance industry.

- Berkshire Hathaway insurance companies, 13.47% shareholder in Moody’s which owns RMS, can increase their revenues by imposing higher insurance rates if the RMS model is manipulated to over-predict climate risk.

- The companies’ ownership also creates traditional pressures on insurance companies to buy and use private models, as opposed to supporting a public model. For example, Moody’s ownership of RMS creates pressure on insurance companies to purchase the RMS model because they are dependent on Moody’s for good credit ratings. Moody’s has the power to downgrade the financial rating of a company that does not use its catastrophe model, or any private model.

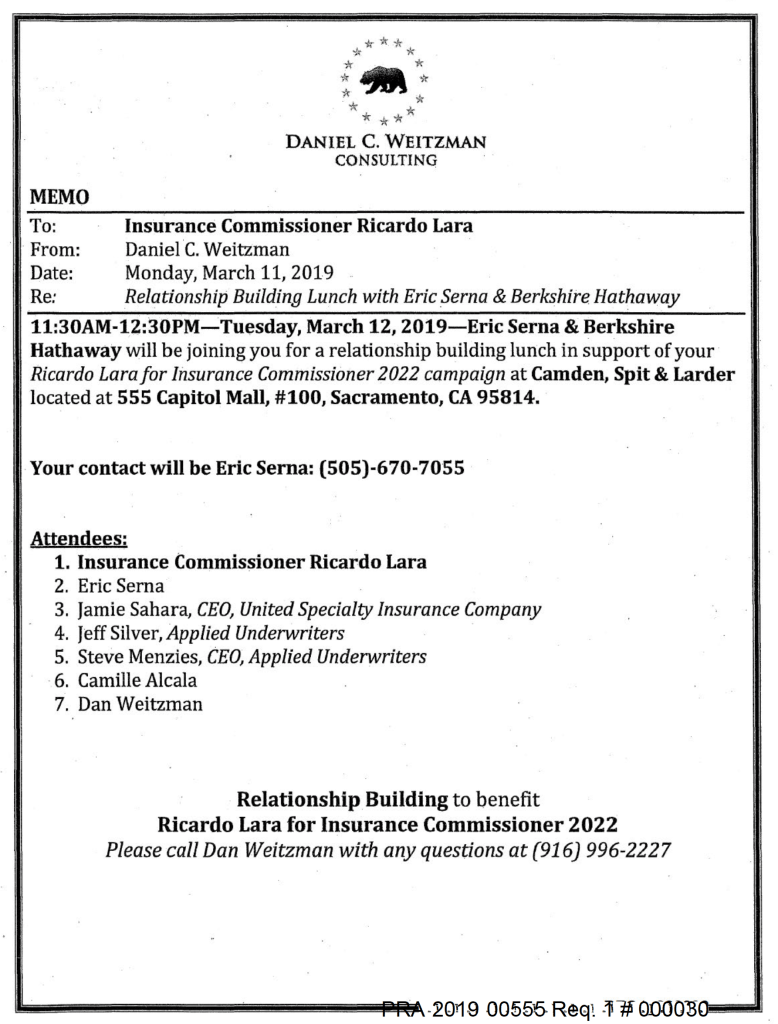

Commissioner Lara has his own history with Berkshire Hathaway, which was at the center of a pay to play campaign scandal at the start of his first term as insurance commissioner. In March 2019, immediately after he was elected, Lara scheduled a “relationship building” lunch with Berkshire Hathaway at the Camden, Spit and Larder restaurant benefiting his 2022 reelection campaign.

The meeting came to light after Lara was engulfed in a campaign finance scandal for accepting tens of thousands of dollars in campaign contributions from insurance companies, after claiming he would not, and was forced to return them. Among those donors were executives of Berkshire Hathaway-owned companies whose representatives were at the March 2019 meeting. Lara later took action benefiting those companies.

Commissioner Lara’s announcement of a deal with the insurance industry to use models did not acknowledge consumer groups’ recommendations that the Department of Insurance investigate the creation of a public model. Consumer Watchdog will call for a public model built with full transparency and public participation to help insurers estimate changing climate risks and prevent artificial inflation of insurance rates.

Consumer Watchdog’s prior written testimony to the Department of Insurance details many additional concerns with models’ inaccuracy, variability and bias, problems that highlight the need for model transparency. Read Consumer Watchdog’s written testimony submitted for today’s workshop here.

“California’s insurance protection laws make transparency in rates non-negotiable. A public model open to full public scrutiny is the only way to ensure climate models are not just a new way for insurers to price-gouge customers,” said Balber. “The Insurance Commissioner’s plan to rush approval of a rule to allow insurance companies’ rates to evade public review is a recipe for unjustified rate hikes.”