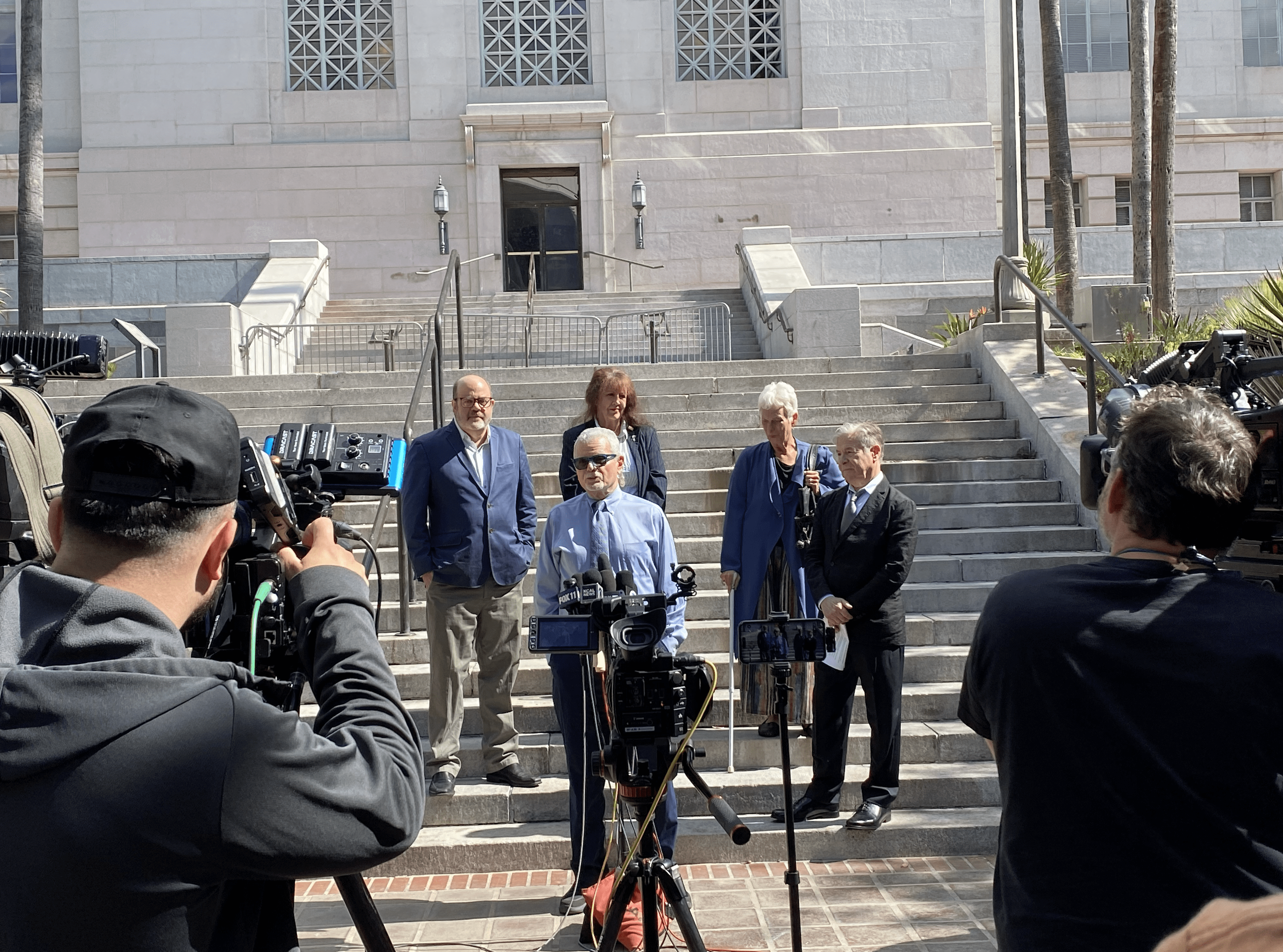

Sacramento, CA — The leaders of Consumer Watchdog have filed a ballot measure guaranteeing insurance coverage to homeowners who meet wildfire mitigation standards set by the state. The “Insurance Policyholder Bill of Rights” also prevents companies from engaging in the “use it and lose it” practice of denying coverage to policyholders who file claims, and extends a host of other new consumer rights.

The initiative also preserves and expands the protections under insurance reform Prop 103 that guarantee that all rates are approved by an impartial, elected insurance commissioner before taking effect. The filing responds to another ballot measure by a wealthy insurance broker that allows insurance companies to raise rates without having to open their books and justify their rates to the insurance commissioner first, repeals Prop 103’s other consumer protections and requires the insurance commissioner to have worked for the insurance industry for at least five years.

Read the initiative.

“The insurance broker’s ballot measure is an existential threat to insurance policyholders who will face more skyrocketing rates and less available coverage if it were to pass,” said Jamie Court, president of Consumer Watchdog and an initiative proponent. “We didn’t ask for this fight, but since the insurance broker started it we are prepared to finish it by addressing what consumers care most about, having home insurance coverage available when they do the right thing and protecting themselves against price gouging and unfair practices.”

“Homeowners deserve to know that when they do the right thing and make their homes safe from wildfires they will have access to home insurance,” said initiative proponent Carmen Balber, executive director of Consumer Watchdog. “The Insurance Policyholder Bill of Rights guarantees that people who invest in wildfire mitigation get coverage and prevents companies from cancelling people simply because they file a claim. California policyholders need more rights, not less, and more independence from their insurance commissioners, not one who hails from the insurance industry.”

“California voters passed 103 during a period of skyrocketing rates to protect themselves against the very same abuses that the new insurance initiative would replace it with,” said initiative proponent Harvey Rosenfield, author of Prop 103 and founder of Consumer Watchdog. “Californians don’t want to go back to a time when the insurance commissioner came from the insurance industry, insurance companies could raise rates as much as they wanted, charge motorists based on any criteria they want, including their ZIP-code or refuse people based on their race, religion or income – and the voters had no power to hold insurance companies or the commissioner accountable. The Insurance Policyholder Bill of Rights gives Californians a way to preserve and strengthen the strong regulation already in California law.”

These are among the protections in the Insurance Policyholder Bill of Rights:

- Requires homeowners insurance companies to sell coverage to anyone who fire-proofs their home.

- Prohibits insurers who refuse to sell homeowners insurance from selling car or home insurance policies to Californians for five years.

- Requires insurers to give customers sufficient time to make home repairs and improvements to prevent nonrenewal of policies.

- Requires insurers to publicly report where, when, and why they are cancelling or refusing to renew homeowner policies.

- Requires insurers to give homeowners at least six months notice if not renewing a policy, and disclose specific documented reasons for the nonrenewal. Homeowners must be given a clear explanation of repairs that would qualify them for renewal, the right to repair and appeal, and automatic extensions if delays are due to factors outside of their control.

- Prevents insurance companies for non-renewing or denying coverage because a policyholder inquires about a claim, files a claim the insurer does not pay for any reason, or makes a claim that was not their fault and for which the risk of loss has been removed.

- Requires insurance companies to give homeowners every version of a loss estimate prepared by an adjuster for the insurance company.

In addition, the ballot measures preserves the provisions of insurance reform Proposition 103 – including the prior approval of rates, the independence of the elected insurance commissioner, the ban on the use ZIP-code in auto insurance and other discriminatory factors, and the public participation intervenor system. The initiative also clarifies the intent of Prop 103 voters, after negative court rulings, that the insurance commissioner and courts have the power to order refunds if consumers are overcharged.

Polling shows strong public support for these provisions.