Sacramento, CA – Insurance companies’ illegal use of job and education level to price auto insurance discriminates against lower income drivers and communities of color and must end, Consumer Watchdog will testify at a California Department of Insurance workshop this afternoon.

The workshop will consider rules proposed after Consumer Watchdog and ten other civil rights and community groups petitioned the Department to ban the use of job and education level in auto insurance rating in 2019. The group will urge the Department to make clarifying amendments and then formally propose the rule for adoption after two years of investigation of the practice, and decades of abuse by insurance companies.

Read Consumer Watchdog’s comments on the proposed regulation.

Read the groups’ February 2019 petition.

California Proposition 103, enacted by voters in 1988, requires auto insurance prices to be based primarily on how a person drives – driving record, miles driven annually, and years of driving experience. It also allowed groups of consumers to band together and negotiate discounts for their members. However, insurance companies have for decades illegally subsidized discounts for drivers with white collar occupations and college degrees by forcing other drivers to pay more.

“For too long in California, insurers have been using education level and occupation as a back-door method to charge drivers of color and lower income drivers more,” said Daniel L. Sternberg, Consumer Watchdog staff attorney. “Proposition 103 prohibits the racial and economic disparities caused by insurance companies’ current practice.”

The proposed rules would end insurance companies’ illegal use of job and education as rating factors, and preserve discounts negotiated by legitimate groups of consumers for millions of their members. They would prohibit insurance companies from only offering group discounts to drivers on a list of well-paid professions or college graduates. For example, AAA offers group discounts to drivers on this arbitrary list of white-collar jobs.

Insurers would have to demonstrate their group discounts are not concentrated in affluent ZIP Codes but are distributed more equitably across California’s lower-income and diverse neighborhoods. If they are not, no group discounts may be offered.

A Department of Insurance report in September 2019 found that insurers’ current practices cause “wide socioeconomic disparities,” with premiums as much as 25% higher for drivers who have lower levels of educational attainment and reside in ZIP codes with lower per capita incomes (reflecting job status) and in which communities of color predominate.

In 2017, just 12.2 percent of Latinx and 24 percent of Black Californians over the age of 25 had a bachelor’s degree or higher. Latinx and Black Californians also earn lower median incomes than white Californians. Undocumented Californians in particular are most likely to have jobs in low-paying industries like agriculture, child care, restaurants, hotels and construction. These communities all pay more to subsidize discounts for drivers with better-paid professions, said the groups in their 2019 petition.

See the draft regulation issued by the California Department of Insurance: http://www.insurance.ca.gov/0400-news/0100-press-releases/2021/release021-2021.cfm

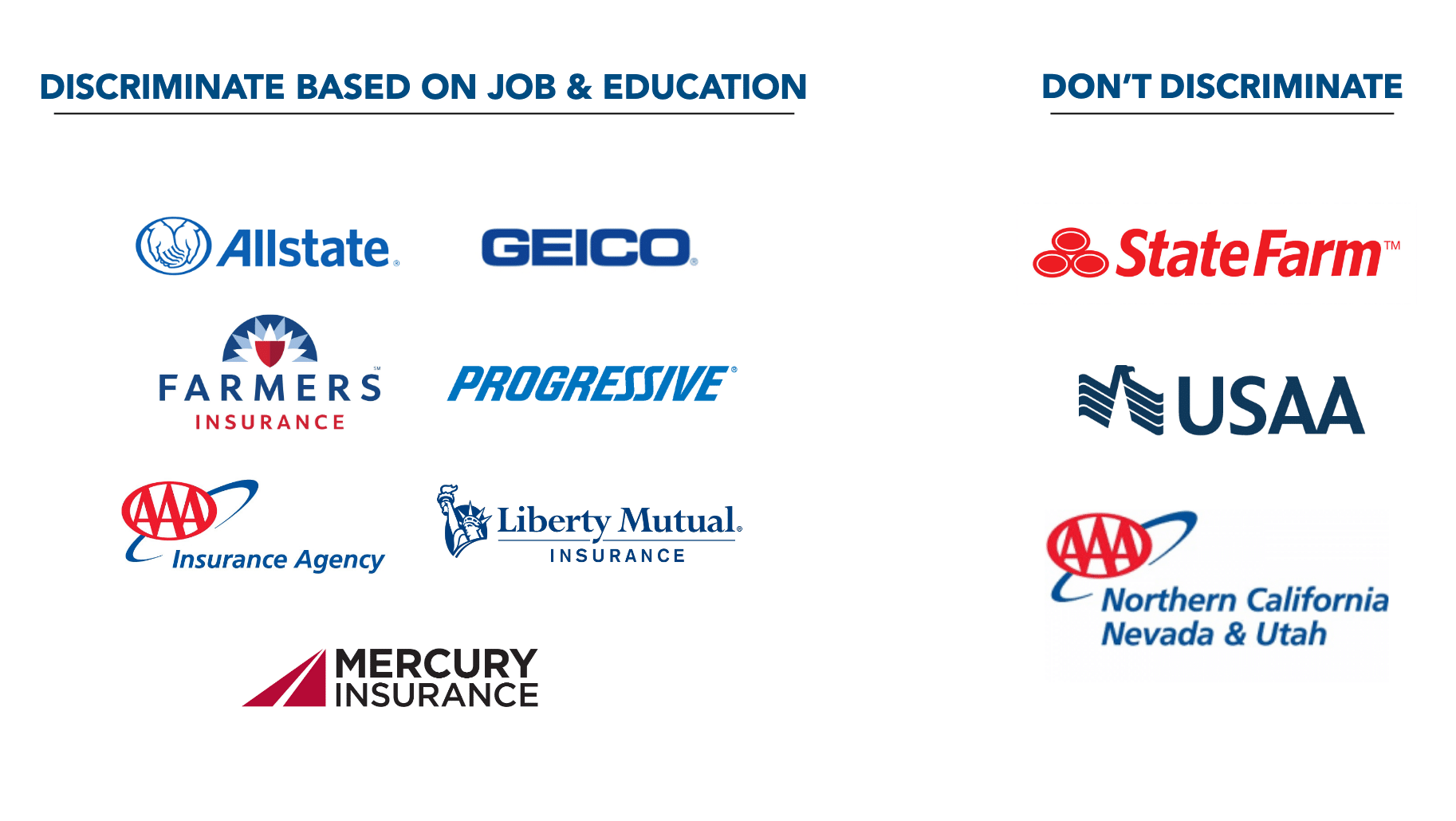

Seven of the top ten auto insurance companies in California currently discriminate against drivers based on job and education.

The state of Massachusetts bans the use of education and occupation to set auto insurance rates; New York banned their use in 2017 unless insurers can prove they do not result in unfairly discriminatory rates; and, legislation to bar the use of education and occupation in auto insurance rating is currently moving through the New Jersey legislature.

– 30 –