The California Energy Commission and newly created Division of Petroleum Market Oversight provided valuable analysis at a recent workshop on the summer outlook for gasoline prices. It all boils down to how many days of supply refiners keep on hand to avoid price spikes. Lack of enough days of gasoline supply precipitated price spikes in late summer and early fall 2022 and 2023, according to the CEC.

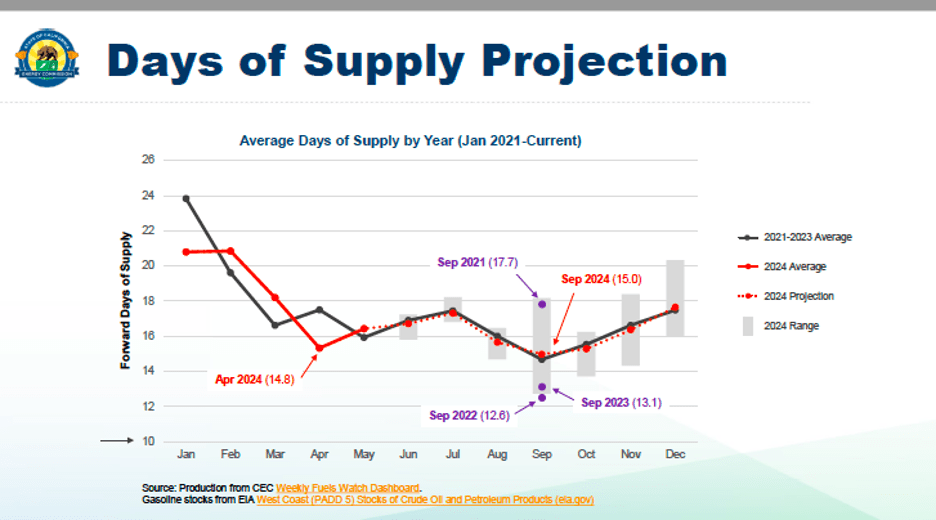

This September, the CEC predicts 15 days of gasoline supply, just enough to feed the state. But California could still see price spikes if refiners choose not to make or import enough gasoline or if anything goes wrong at a refinery, causing an unplanned outage. As Siva Gunda, the CEC’s lead commissioner for energy assessments and reliability, summed it up: “A lack of slack in California creates price spikes, that is just it.”

Whenever prices spike more than a dime a gallon, “consumers face an extra burden of $4 million a day at the pump,” according to Gigi Moreno, chief economist at the newly created Division of Petroleum Market Oversight. In 2023, consumers experienced a 70-day price spike that took another 35 days to return to trend.

That is an unacceptable price to pay. But extreme market concentration—four refiners control 90% of the gasoline market—tempts refiners to create conditions for price spikes.

“The petroleum industry needs active oversight to promote competition and protect consumers,” Moreno said. “In an increasingly concentrated market, decisions on reduced refinery output will have a bigger impact on prices.”

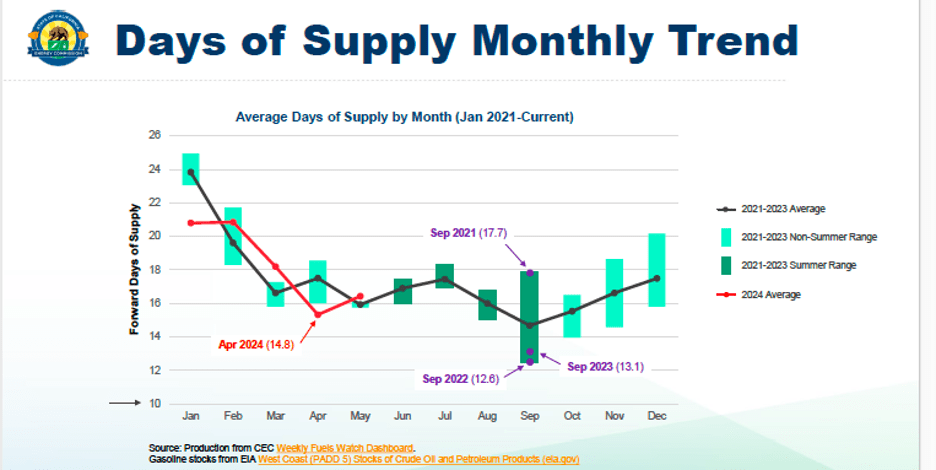

Refineries typically build up inventories in advance of the summer driving months and then draw them down to meet demand into late summer before building up again. But California is on a knife’s edge when it comes to refiners balancing their production with imports to maintain adequate inventories, according to the CEC’s research.

The fact that refiners are making less gasoline doesn’t help. Between 2021 and 2023, refiners made 12% less gasoline than they did between 2014 and 2019. In 2024, the CEC estimates another 5% drop over that.

A look at price spikes at the pump in October 2022 and September 2023 shows how this works. California prices per gallon—consistently a dollar or more higher than the rest of the nation—spiked well over $6 a gallon with Californians paying more than $2 more per gallon than average US prices at those times. Those spikes tracked with West Coast gasoline inventories on hand measured in days of supply.

In September 2022, in advance of the October spike, the average number of days of supply on hand was just 12.6. In September 2023, the average number of days of supply on hand was 13.1, again correlated to a spike in gas prices.

Generally, at least 15 days of supply lowers the risk of price spikes and anything below that line significantly raises the risk.

Last summer, refiners reported large reductions in gasoline supplies and few supplemental supplies between June and December 2023, according to Moreno. They also conducted planned maintenance in the second half of 2023, reducing supply by over 260 million gallons with 60 million of that reduced in September alone. Market concentration likely magnified the impacts of planned maintenance, according to Moreno.

“They chose to conduct maintenance in the summer when there is lower capacity,” said Moreno. “During summer months, gasoline demand is at its peak. We are more likely to see price spikes. The industry provided little supplies from outside CA to mitigate the impacts of reduced gas production during planned maintenance.

“Planned maintenance contributes to supply disruptions and price volatility. That creates a considerable burden on consumers and makes the market more susceptible to manipulation….In general, providing fertile ground for market participants to discretely manipulate the market.”

The cure is keeping enough days of supply of gasoline on hand to avoid price spikes. As Moreno put it, “Responsible resupply plans are critical to maintain price stability during maintenance.”

Europe provides an example of how to do that. EU countries must maintain emergency stocks of crude oil and petroleum products equal to at least 90 days of net imports or 61 days of consumption, whichever is higher. The UK requires that a minimum of 22 days of supply be held.

California should take a page from Europe and not hesitate to impose its own requirements on days of gasoline supply that refiners must hold to shield consumers from price spikes that cost them too dearly.