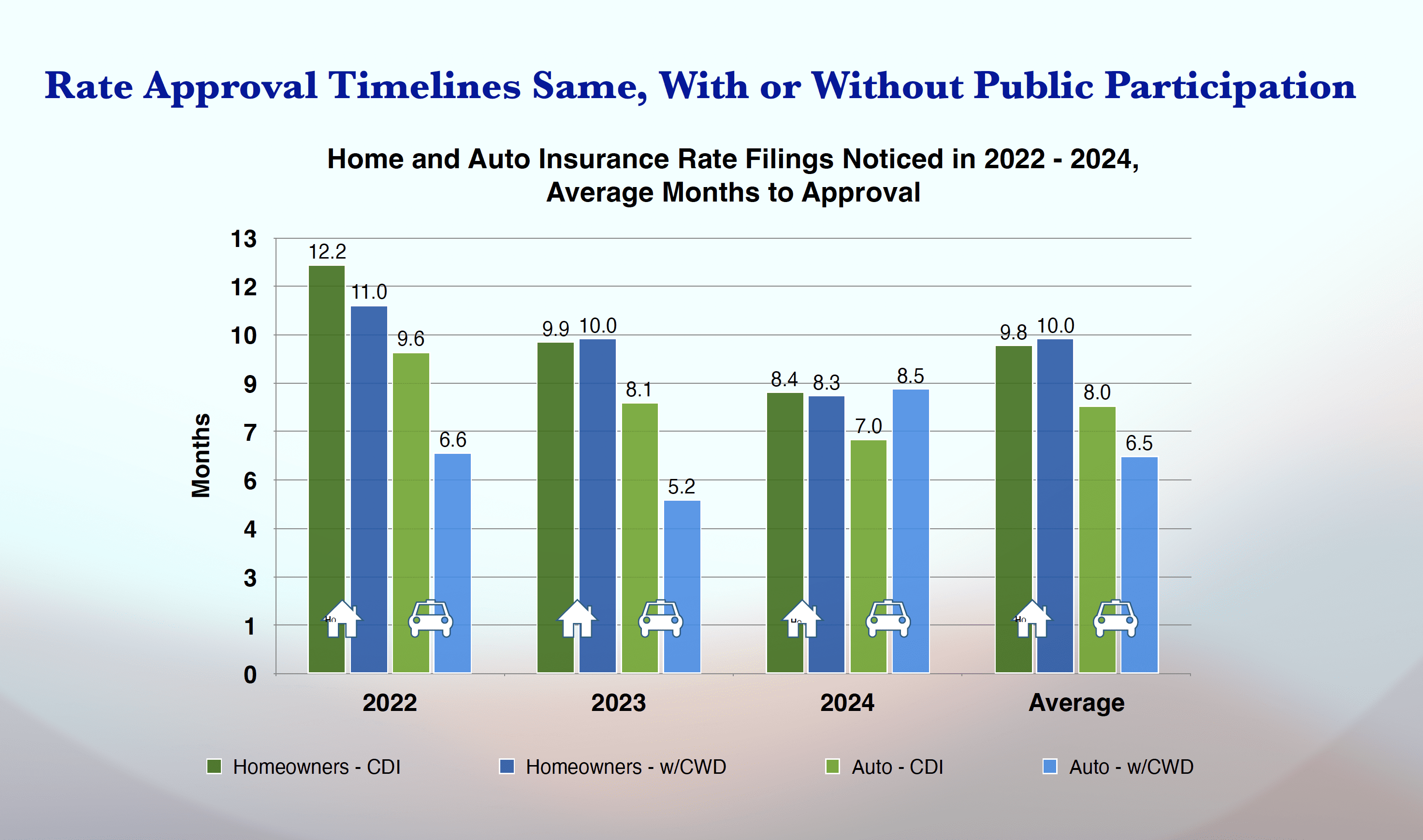

Sacramento, CA – Updated data from the California Department of Insurance (CDI) continues to show rate approvals are as fast, or faster, when Consumer Watchdog is involved than when the Department acts alone.

Home insurance rate approvals are the same on average when Consumer Watchdog (CW) intervenes compared to when CDI acts on its own (10 months with CW vs 9.8 months just CDI). Approvals are approximately 45 days faster on average for Consumer Watchdog auto insurance challenges as opposed to when CDI reviews auto insurance rate hikes alone (6.5 months with CW vs 8 with just CDI).

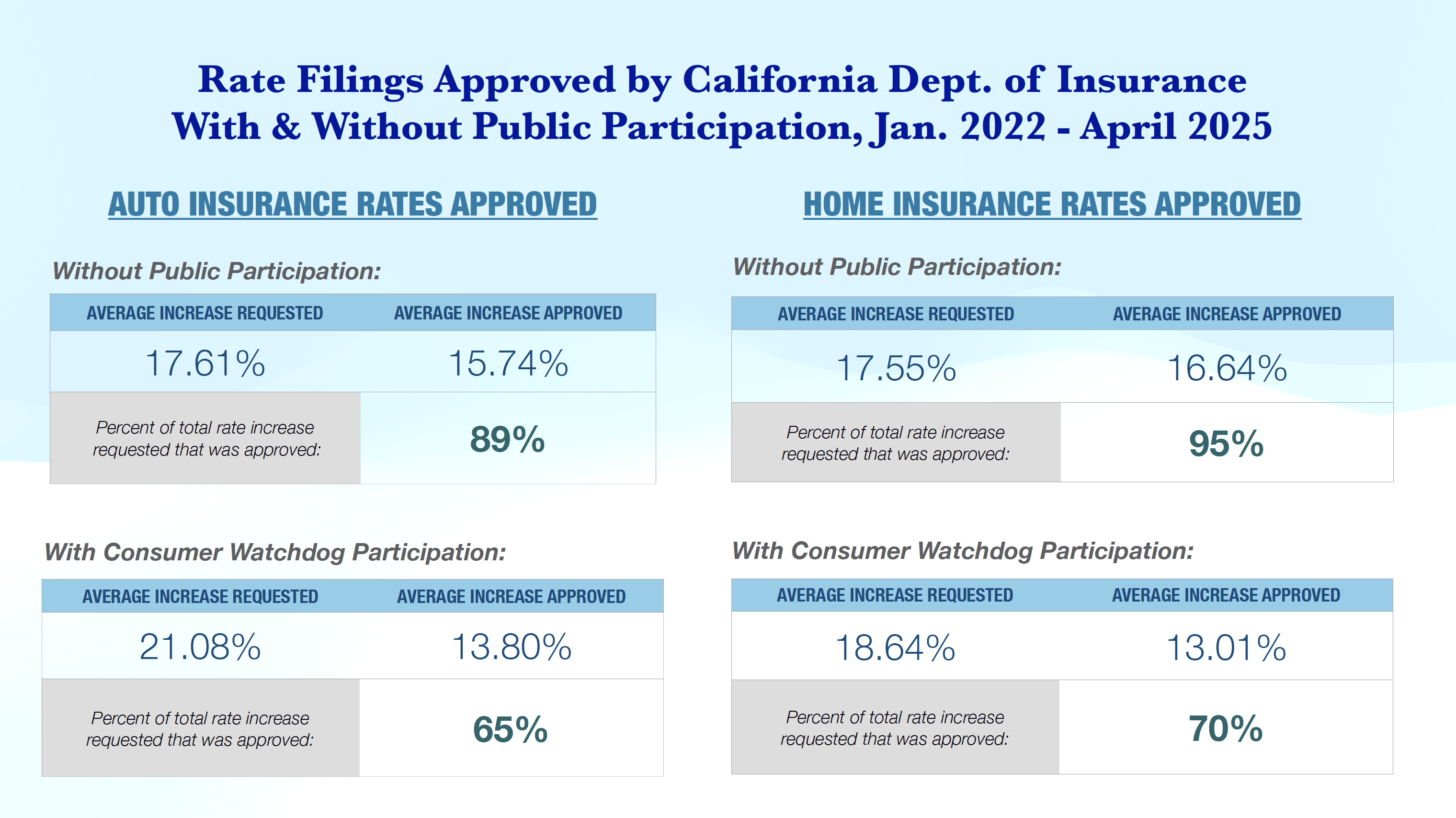

In addition, updated data shows that public intervention continues to significantly reduce rates. When the Commissioner was the only party to a proceeding he approved 95% of the rate requested in home insurance cases and 89% in auto insurance cases from the period between Jan 1, 2022 and April 2025. When Consumer Watchdog intervened, the rate approved was 70% of the rate requested in homeowner insurance cases and 65% of the rate requested in auto insurance cases.

“The data shows the intervenor process saves money and does not add time to rate increase requests,” said Jamie Court, president of Consumer Watchdog. “Consumer Watchdog’s interventions have saved $6.5 billion for consumers at a cost of $14 million to insurance companies, or twenty five cents for every one hundred dollars saved. Commissioner Lara’s proposed regulations will prevent consumer groups from being paid and discourage participation. That could cost insurance consumers billions in savings over time.”

Public Citizen responded to Commissioner Lara’s attempt to put new hurdles on consumer groups getting paid for their rate interventions.

“Attacking California’s public intervenor program is a short-sighted attempt to scapegoat consumer advocates for what is clearly a national crisis,” said Carly Fabian, senior insurance policy advocate with Public Citizen’s Climate Program in a statement. “Allowing insurers to raise rates with no public oversight is a recipe for chaos, not a serious strategy for confronting the cost of climate change. Adapting insurance systems to climate risk is essential, but that doesn’t mean shutting out the public….As the private market runs away from risks, this is the time to strengthen, not dismantle, these programs. Compensating intervenors is one of the best and most cost-effective ways to do that.”

The rate time calculation includes the timeline of every personal home and auto insurance rate increase by an insurance company that was filed and approved over the most recent three year period between Jan 1, 2022 and Dec 31, 2024. The spreadsheet showing those calculations and the rate filings involved is available upon request.

The Department of Insurance is quoted as saying that rates take twice as long to approve when intervenors are involved, but have failed to produce an analysis and their numbers don’t match the public record. CDI doesn’t explain where their number came from. The Department is possibly including rate changes for lines of insurance where Consumer Watchdog doesn’t intervene, which is not a fair way to compare how long approvals take with and without intervenors.

“It’s ironic that Commissioner Lara complains about a lack of transparency when he has billed taxpayers for five star travel across the world, including an African safari, limos and a stay at an elite resort in Dubai, and failed to produce public records showing the purposes of that travel for nine months,” said Court. “It is Commissioner Lara who needs to be more transparent and accountable to the public.”