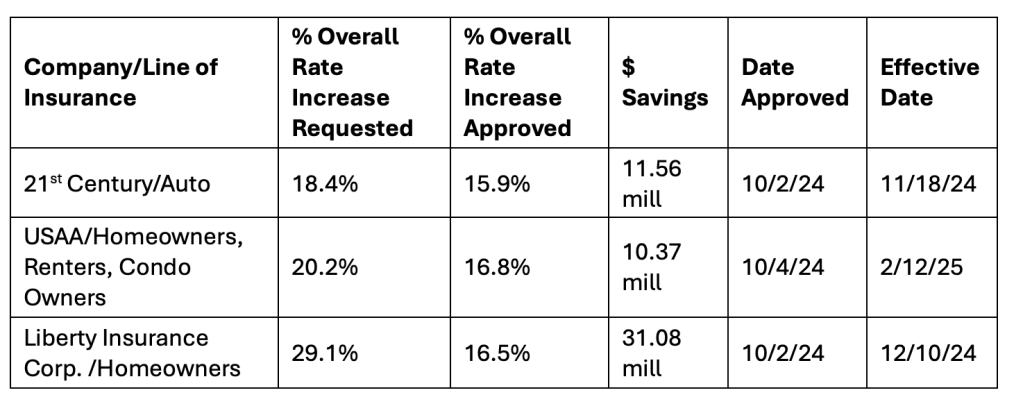

Los Angeles, CA — Consumer Watchdog recently reached settlement in three challenges to double-digit rate hikes requested by 21st Century Insurance Company for its auto policies, United Services Automobile Association (“USAA”) for its homeowners, renters and condo policies, and Liberty Insurance Corporation for its homeowners policies. Consumer Watchdog’s advocacy resulted in a total savings of more than $53 million for California policyholders. The three companies’ newly-approved rates will take effect for all new and renewal policies between November 18, 2024 and February 12, 2025, and will impact over 671,000 policyholders combined.

According to Consumer Watchdog’s analysis of the rate filings, the companies were overstating projected losses, causing their proposed rates to be excessive by millions of dollars. “Given the current state of the California insurance market, with insurer-created shortages and massive rate increases, it’s important that applications are closely scrutinized,” said Consumer Watchdog Staff Attorney Benjamin Powell. “Consumers’ seat at the table to challenge excessive rates is critical, especially when insurance companies are requesting multiple major rate hikes in the same year.”

In each case, Consumer Watchdog successfully advocated for lower overall rate increases under Prop 103 and prior approval rate regulations, which require insurers to justify all rate changes prior to implementation.

In the 21st Century proceeding, the company initially sought a rate increase of 18.4% to its automobile insurance policies. This request followed a prior $29 million dollar rate increase effective January 2024. Consumer Watchdog challenged the rate hike as excessive under Prop 103 and the Department’s ratemaking regulations, specifically challenging 21st Century’s projected losses as being inflated for giving too much weight to recent losses. Additionally, Consumer Watchdog alleged that 21st Century’s method for projecting Bodily Injury and Uninsured Motorist claims would have resulted in excessive rates. Finally, Consumer Watchdog argued that 21st Century was trying to charge consumers for institutional advertising (ads designed to improve the company’s image rather than aimed at selling specific insurance products), in violation of state rules. (Read Petition)

Consumer Watchdog requested that 21st Century provide further information to substantiate its application, and successfully advocated for a lower rate increase of 15.9%, representing a savings to California policyholders of more than $11.5 million. (Read Stipulation)

In the USAA proceeding, the company sought an overall rate increase of 20.2% for its homeowners, condo and renters policies combined, which would have cost California policyholders an overall $53 million. Consumer Watchdog challenged the rate hike as excessive, calling out United Services’ projected losses as being overinflated. Consumer Watchdog also alleged that USAA was in violation of the rules by failing to provide required information to the Department to substantiate its loss projections. Finally, Consumer Watchdog argued that USAA, like 21st Century, had failed to properly exclude expenses for institutional advertising. (Read Petition)

Consumer Watchdog requested that USAA provide further information in order to substantiate its claims about losses and other information in its application. Consumer Watchdog ultimately achieved a lower rate increase of 16.8%, saving California policyholders a total of more than $10 million. (Read Stipulation)

In the Liberty proceeding, the company sought an overall rate increase of 29.1% for its homeowners insurance policies, at a total cost to California policyholders of over $67 million. Consumer Watchdog argued that the requested rate increase was excessive. As with the 21st Century and USAA filings, Consumer Watchdog argued that Liberty’s trend selections overstated the projected losses, leading to an inflated rate indication. Additionally, Consumer Watchdog challenged Liberty’s claim that only 1% of its advertising expenses were “institutional” in nature. (Read Petition)

Consumer Watchdog sought additional information from Liberty that would support its trend selections and institutional advertising percentage. Through this information exchange Consumer Watchdog convinced the Department that Liberty’s institutional advertising percentage should be 100%, not 1%.

“Consumers are inundated with ads from insurance groups, with nearly 10% of all television advertising expenses coming from insurers,”[1] said Consumer Watchdog staff attorney Ryan Mellino. “Prop 103 protects consumers from paying for general advertising. If insurers are going to expend billions of dollars in collected premiums on ads, that expenditure must be properly reflected in their rate filings.”

Consumer Watchdog ultimately agreed that a 16.5% rate increase, reflecting just over half of the 29.1% increase Liberty initially sought, was reasonable, saving policyholders over $31 million. (Read Stipulation)

California’s voter-approved insurance reform law, Proposition 103, requires that insurers open their books and prove they need to raise rates in a process subject to full transparency, in which consumer representatives have the right to review and challenge improper rates and practices. According to the Consumer Federation of America, Prop 103 has saved California motorists over $154 billion since 1989. Consumer Watchdog has saved California consumers over $6 billion over the last 22 years by challenging excessive and unfair auto, home, business, and medical malpractice rates.

For more information about Proposition 103 visit: https://consumerwatchdog.org/prop-103/

[1] Doug Bailey, Insurance industry ads continue to be among top watched, InsuranceNewsNet, Aug. 22, 2022, https://insurancenewsnet.com/innarticle/insurance-industry-ads-continue-to-be-among-top-watched.