Santa Monica, CA — Public challenges to auto, home, medical malpractice and earthquake rate hikes proposed by insurance companies but proven excessive have resulted in more than $3 billion saved for consumers since 2002.

Santa Monica, CA — Public challenges to auto, home, medical malpractice and earthquake rate hikes proposed by insurance companies but proven excessive have resulted in more than $3 billion saved for consumers since 2002.

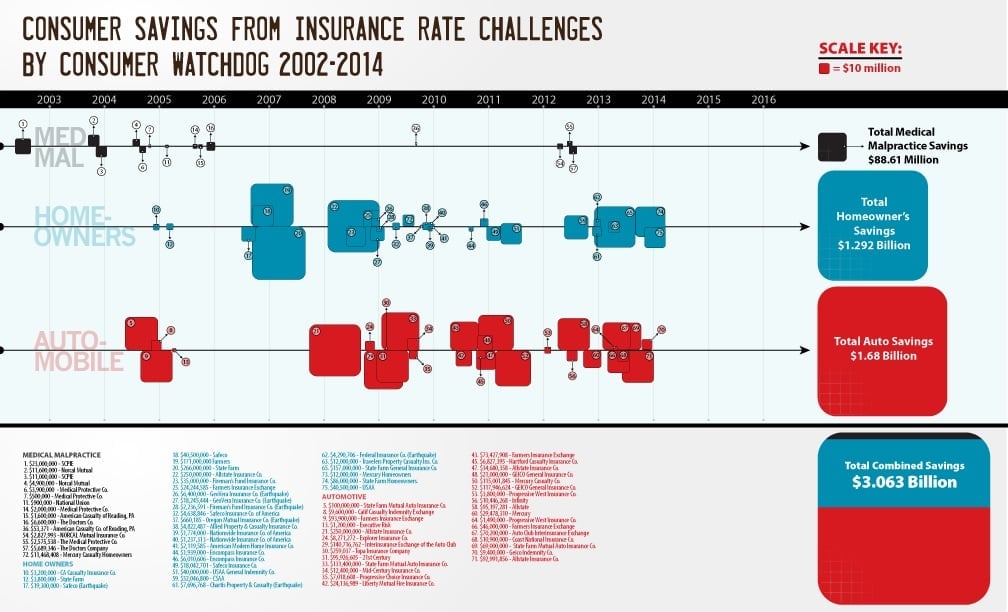

A chart of the more than $3 billion saved in more than 80 challenges over the last twelve years by Consumer Watchdog is available at: http://www.consumerwatchdog.org/sites/default/files/images/RateSavingsChart-5-12-14.png

A pending ballot measure would extend the same public challenges and prior approval system to health insurance rates.

The latest $40.5 million savings for USAA homeowner policyholders is a result of the nonprofit Consumer Watchdog’s challenge and subsequent agreement by USAA with the California Department of Insurance (CDI) and Consumer Watchdog. The Commissioner approved an overall rate decrease of 13.6%, resulting in savings to USAA policyholders of $40.5 million. The chart below illustrates the requested and approved rates by USAA affiliate, program, and overall.

The group challenged USAA and its affiliates’ 2013 homeowners insurance rate filings with CDI, alleging that the requested rates were excessive and an overall double-digit rate decrease was justified under the prior approval regulations defining excessive rates.

“California policyholders would have paid at least $3 billion more for their insurance but for the voters’ wisdom in enacting Proposition 103’s public participation provision in 1988 and guaranteeing that the public has a tool to stop excessive rate hikes,” said Pam Pressley, Consumer Watchdog’s Litigation Director.

“USAA’s rate reduction marks another successful implementation of the quarter century old initiative by protecting USAA policyholders from excessive rates,” said Cathy Lee, Staff Attorney for Consumer Watchdog.

As Consumer Watchdog pointed out during the proceeding, USAA’s requested rates were inconsistent with the high level of profits the company earned in its homeowners line of business in recent years; the company gained an underwriting profit of approximately 35% of premium it collected in 2013, underscoring the need for a substantial rate decrease.

The rate decrease will be implemented on October 1, 2014. As part of the agreement, USAA must justify its rates by filing another homeowners rate application in 2015. This requirement will allow the CDI and Consumer Watchdog to monitor USAA’s data going forward and determine whether a further rate decrease will be warranted.

Although USAA will reduce its overall rates by $40.5 million, the actual premium change will vary for each customer and a small number customers may see slight premium increases as a result of their unique coverage needs and other factors.

Under California’s insurance reform law, Proposition 103, consumers, and consumer groups have the right to challenge rates and practices of insurance companies, and companies cannot alter rates without the prior approval of the Insurance Commissioner. Without those protections USAA would not have lowered rates, according to Consumer Watchdog.

After a separate challenge to State Farm’s request for a 6.9% rate hike, the largest homeowners insurer in the state recently agreed to lower its rates by -1.2% overall, saving policyholders $86 million. That rate decrease will take effect for all State Farm homeowners policies issued on or after May 15, 2014.

|

CDI App. No. |

Applicant |

Line |

Program |

Request |

Approved |

|

13-3754 |

United Services Automobile Association |

Personal Homeowners Multi-Peril |

Owner Occupied |

0.00% |

-6.10% |

|

13-3772 |

United Services Automobile Association |

Personal Homeowners Multi-Peril |

Condominium |

-4.61% |

-8.00% |

|

13-3954 |

Garrison Property And Casualty Insurance Company |

Personal Homeowners Multi-Peril |

Owner Occupied |

0.00% |

-24.00% |

|

13-3955 |

USAA Casualty Insurance Company |

Personal Homeowners Multi-Peril |

Owner Occupied |

0.00% |

-24.00% |

|

13-3998 |

USAA General Indemnity Company |

Personal Homeowners Multi-Peril |

Owner Occupied |

0.00% |

-7.00% |

|

13-3993 |

Garrison Property And Casualty Insurance Company |

Personal Homeowners Multi-Peril |

Condominium |

4.20% |

-1.00% |

|

13-3994 |

USAA Casualty Insurance Company |

Personal Homeowners Multi-Peril |

Condominium |

4.20% |

-1.00% |

|

13-3995 |

USAA General Indemnity Company |

Personal Homeowners Multi-Peril |

Condominium |

4.20% |

-1.00% |

|

|

|

|

Overall |

0.00% |

-13.6% |

– 30 –