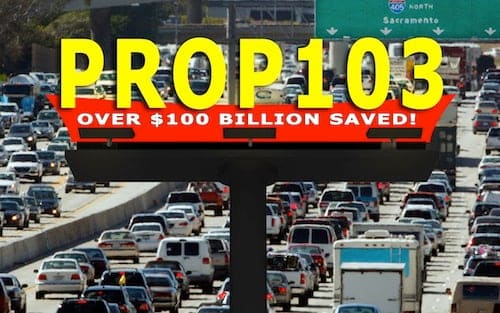

Santa Monica, CA – California is the only state in the nation where auto insurance premiums, in real dollars, are lower today than they were 27 years ago when the voters approved insurance reform Proposition 103. The law has saved drivers $100 billion on their insurance since 1988, according to a study by the Consumer Federation of America. Still, California auto insurance companies earn higher profits than the national average, and the market ranks fifth most competitive in the nation using the standard applied by the U.S. Department of Justice.

Santa Monica, CA – California is the only state in the nation where auto insurance premiums, in real dollars, are lower today than they were 27 years ago when the voters approved insurance reform Proposition 103. The law has saved drivers $100 billion on their insurance since 1988, according to a study by the Consumer Federation of America. Still, California auto insurance companies earn higher profits than the national average, and the market ranks fifth most competitive in the nation using the standard applied by the U.S. Department of Justice.

The R Street Institute, which released a report today attacking Proposition 103, is backed by the insurance industry, including representatives of State Farm and Renaissance Reinsurance on its Board of Directors.

“When consumers save $100 billion and counting, and insurance rates hold steady for 27 years, it’s no surprise when an industry-backed group attacks the consumer protection law that’s responsible,” said Carmen Balber, executive director of Consumer Watchdog.

Consumers save under Proposition 103 because insurance companies are required to justify and get approval for rate increases before they take effect. Proposition 103 also requires auto insurance rates to be based primarily on driving record, miles driven and experience. The rules prevent insurance companies from using discriminatory factors like a driver’s education, job, credit score, ZIP Code or lack of prior insurance, to increase rates. These prohibitions raise the industry’s ire, said Consumer Watchdog.

Proposition 103 allows the public to participate in the rate-making process. Since 2003, Consumer Watchdog challenges to excessive auto, home and malpractice insurance rates have saved insurance policyholders $3.06 billion. Those savings include over $500 million saved for homeowners insurance policyholders with R Street Institute board member State Farm since 2006.

See a chart of the savings: http://www.consumerwatchdog.org/sites/default/files/images/RateSavingsChart.png

The Consumer Federation of America studied the impact of auto insurance rate regulation in every state in a recent report. Among the report’s findings:

• California is the only state where auto insurance rates went down in real dollars since 1988. The average national rate increase from 1989-2010 was 43.3%.

• Proposition 103 reduced auto insurance rates in California. The state had the 3rd highest rates in the country in 1988. Today California ranks #22.

• Auto insurance companies in California are more profitable than the norm. The median national average profit from 1989 to 2010 was 9.1%. California auto insurance companies had an average profit of 12.1% over the same time period.

• California has the 5th most competitive market in the nation using the Herfindahl-Hirshman Index, the test commonly employed to measure competitiveness by the U.S. Department of Justice.

• Prices rose least in states with prior approval rate regulation compared to all other forms.

Read the report: http://www.consumerfed.org/pdfs/whatworks-report_nov2013_hunter-feltner-heller.pdf

– 30 –