Santa Monica, CA – Consumer Watchdog pointed today to big new California oil profit reports, gasoline pricing data and a candid remark from a refinery CEO to show that the companies are making unreasonable profits from California drivers due to their market power and anti-competitive practices.

Today oil refiner Tesoro reported $332 million in profits from California oil refining during the second quarter. Valero had reported $141 million in state oil refining profits during the second quarter, nearly triple its average quarterly profit of $57 million. These are the only two refiners that report California-only oil refining profits.

Consumer Watchdog said the high profits from the state refiners that report them helps to explain the odd, extreme current gap between retail and wholesale gasoline prices in the state.

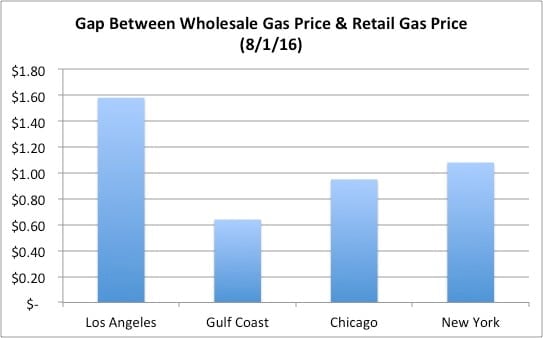

Currently, California’s wholesale market for gasoline, where oil refiners trade gas, is the cheapest in the country, but California drivers have been paying the highest price in the nation for a gallon of gasoline on the street.

The price of gas at the pump in California usually costs 88 cents more than the price on the wholesale market. Today, drivers are paying $1.58 more than the wholesale market, a windfall for refiners, who are pocketing most of that extra cost.

See Consumer Watchdog’s Presentation here: http://www.consumerwatchdog.org/resources/wholesale_press_conference.pdf

“With all of California’s refineries back online, drivers should be paying 70 cents less at the pump,” said Consumer Watchdog researcher Cody Rosenfield. “There’s no shortage. There are no refinery problems. Where are the savings for consumers?”

On the California wholesale “spot” market where refiners trade large amounts of gasoline, a gallon costs $1.17, the lowest in the country, and 18 cents less than in Chicago, due to an overabundance of supply. Despite that, street prices in California are 45 cents more per gallon than in Chicago.

Consumer Watchdog is providing this evidence to the California Attorney General’s office in support of its ongoing investigation into California gas price manipulation, where subpoenas have recently been issued. The difference between the spot price and the retail price is the larger than its ever been – excluding October of 2008, during the market crash.

On a recent investor call, California’s newest refiner made some startling admissions that help explain last year’s record gasoline price gap with American gas prices — $1.60 cents more.

Consumer Watchdog pointed to the remarks of Tom Nimbley, the CEO of PBF Energy, the company that purchased the troubled Torrance refinery from ExxonMobil. During an investor call on July 29th, in response to a question about why the Torrance refinery had so many issues, Nimbley said that Exxon’s equipment was top notch, but the problem was Exxon’s culture. He said, “I personally believe Exxon probably had made a decision that they were not going to run a single refinery operation in the state of California,” suggesting that Exxon intentionally kept the Torrance refinery, which supplies 20% of Southern California’s gasoline, offline.

Nimbley also admitted he and others in the industry were going to cut back on refinery operations to limit supply and inflate prices. He said, “bottom line is there’s too much clean product and the only way you can solve that problem is reducing the amount of clean product that you make.”

The transcript follows below.

“When refiners sell gasoline to each other at the cheapest price in the nation, but then turn around and sell it to us at the highest price in the country, we can clearly see excessive market power at play,” Rosenfield said.

The recordings are available at:

Exxon Decision: http://www.consumerwatchdog.org/resources/exxon_decided_to_keep_offline.m4a

Production Cuts: http://www.consumerwatchdog.org/resources/production_cuts.m4a

Evan Calio: Okay. That’s good. My second question. On the last call you mentioned about a 50,000 barrel a day swing capacity in your four refineries system. Before Torrance, between diesel and gasoline. How are you running today given price signals? Are you still full tilt gasoline and how quickly can that change given the right price signals?

Thomas J. Nimbley: As we said before, the 50 is before Torrance. Torrance has some capability to swing between but not as much. It’s a gasoline machine. We can make those moves very quickly. It’s simply a matter of changing the cut points on various powers. There’s a certain amount of material that comes out of cat crackers, hydrocrackers or crude units that can go into either product to a limit obviously based on product constraints. And that’s simply a function of cutting the temperatures or increasing the temperatures. It’s almost instantaneous. The rest of it surrounds putting distillate into gasoline.

We did that in the first quarter. I think the whole industry did because we obviously have this large overhang of distillate coming out of the warm winter. And mechanically, we created – we took a distillate problem and turned it into a gasoline problem. So at the end of the day we can make those switches but the bottom line is there’s too much clean product and the only way you can solve that problem is reducing the amount of clean product that you make.

Paul Cheng: And Torrance, just curious there, is there any data you can share in terms of what is the cash operating costs may look like? And also that when you’re looking at the improvement that you’re going to do, is it more hardware related? Or just the culture of the people?

Thomas J. Nimbley: That’s a great question, Paul. First question is we’ve basically some of the plants that Exxon had and we’re honing them as we speak. So we believe we’re going to be – we have to get some cash operating costs out of there. We know how we’re going to do that to a certain extent, I don’t want to go into it on the line, because it’s just – we haven’t divulged all of our plans and reviewed them internally, even with the people of Torrance, but we recognize that we’ve got to get a fair amount of monies, $50 million or so, out of Torrance on a go-forward basis on the cash side, operating as a merchant refinery.

Second part of your question, this is a culture issue. I said this to the people at Torrance, the hardware is unbelievably good. Exxon spent a ton of money fixing things that they obviously had problems with. As I look at Torrance, this is a facility that has somewhat been under a black cloud for a period of time because Exxon – I personally believe Exxon probably had made a decision that they were not going to run a single refinery operation in the state of California.

And then if you go fast forward to February of 2015 when this explosion took place. Envision these people going to work inside the fence line every day, 12 hours, trying to put that place back together and then going home and seeing their colleagues on the nightly news getting blasted because of their being poor performers. To a certain extent they were beating down a group of people. They’re better than that. We know they are better than that. It’s all about changing the culture to be a merchant refinery. To understand that this is a core asset for PBF. It wasn’t a core asset for Exxon. This is all Baytown in effect and get them to really engage. So far, we’ve been enthused about it. The talent level is there. It’s just a question of changing the culture so you are spot on.”

– 30 –