Insurance Commissioner Ricardo Lara’s latest regulation to get insurers covering California again has another massive loophole. Insurers’ so-called commitment to increase sales in risky areas could be as small as a 5% increase.

Lara announced last week that insurers who agree to sell in distressed areas, increasing coverage to at least 85% of their market share in the rest of the state, will get the right to raise all home insurance rates with secret algorithms. The coverage expansion is the one thing in his whole strategy to help the insurance industry that was supposed to benefit consumers.

But a close reading of the text of the regulation and some solid reporting from CalMatters make clear that even that 85% commitment is false. Companies could opt instead to increase sales within distressed areas in California by just 5%, a potentially much lower commitment.

“Insurance companies would have these three options:

- Write 85% of their statewide market share in high-risk areas. The department explains it this way: “If a company writes 20 out of 100 homes statewide, it must write 17 out of 100 homes in a distressed area.”

- Achieve one-time 5% growth in the number of policies they write in high-risk areas.

- Expand their number of policies 5% by taking people out of the strained FAIR Plan, a pool of insurers the state requires to provide fire-insurance policies when property owners can’t obtain insurance elsewhere.”

So insurance companies could increase their sales in distressed/wildfire risk areas not up to at least 85% of their market share as announced, but by just 5%. For any insurance company that has already abandoned most homeowners in fire zones that’s a pretty negligible promise. But in return they’ll still get the right to dramatically hike premiums for all of us with the use of secret algorithms in black box catastrophe models, and charge consumers for the unregulated cost of reinsurance premiums.

Here’s where that loophole is in the text of the regulation:

(d) Insurer commitments with respect to qualifying residential property insurance.

The insurer shall commit in writing to achieving no later than two years (730 days) after the approval of its rate filing (the insurer’s “performance date” hereinafter), or maintaining, the insurer’s earned exposure commitment in the distressed areas of the state as follows:

(1) Eighty-five percent standard.

…

(2) Five percent increment.

The insurer may instead commit to writing additional policies as specified in subdivision (d)(3) in the voluntary market inside the distressed areas of the state such that, on the performance date, the insurer has increased its number of earned exposures inside the distressed areas by at least the number of policies equal to 5% of its earned exposures in the distressed areas of the state within the most recent 12 month period used in its recorded period as submitted in the insurer’s rate application pursuant to subdivision (c) of the section.

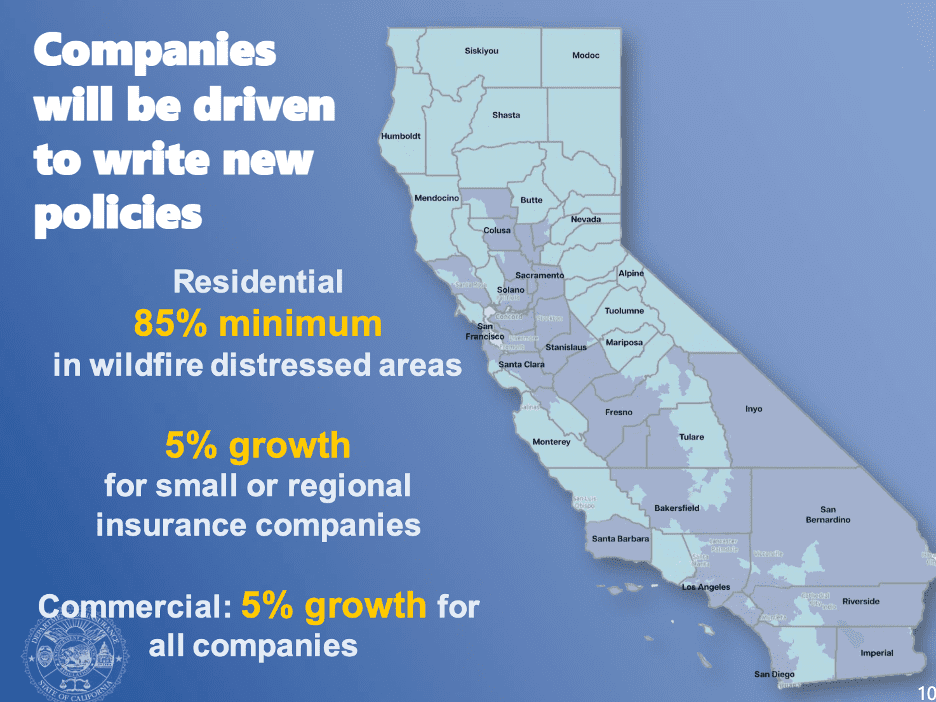

The Commissioner told it differently in his closed-to-the-public media briefing about the rule. From that presentation:

And since that briefing was held without giving reporters the benefit of seeing the text of the regulation beforehand, many reported it like he told it – that the 5% increment would apply to small or regional companies and the commercial market, not be an option for every insurance company.

This new revelation is one more loophole that will let insurance companies off the hook for moving back into the parts of California they have abandoned.

That’s on top of the other problems we highlighted in our press release:

- Rates will go up for every Californian.

- Policies in fire areas are likely to be too expensive for most homeowners to afford.

- Coverage commitments do not begin for 2 years while insurance companies would be able to raise rates using black box models immediately.

- Lets insurance companies off the hook if they fail to meet their commitments. An insurance company that has not met commitments after 2 years has only to show it is “taking reasonable steps to fulfill its insurer commitment.” Another section allows insurance companies that can’t meet their goals to propose “alternative commitments” for many reasons, including high claims.

- Does not apply to small insurance companies or those newly entering the market. Insurance companies that recently stopped writing all policies in California could be allowed to return and still refuse to sell in “distressed areas.”

All the price hikes and deregulation Commissioner Lara has promised the insurance industry will leave Californians paying more with nothing to show for it. The only way to guarantee we get people covered again is with a mandate that insurers cover people who fireproof their homes.