Sacramento, CA — Today’s announcement by Insurance Commissioner Ricardo Lara that he would allow insurance companies to use secret algorithms to set rates for homeowners’ coverage for wildfire and to add reinsurance costs to premiums will lead to higher insurance premiums, Consumer Watchdog said this afternoon.

In an obviously orchestrated sequence of events, Lara’s announcement came shortly after Governor Newsom released a vague “executive order” that seemed to “request” Lara to take further actions to undermine the protections against insurance price-gouging and discrimination enacted by the voters as part of Proposition 103.

“Insurance companies are using their economic power to create shortages for the purpose of pressuring elected officials to change the rules that have kept insurance premiums in California stable, affordable and available for decades,’’ said Harvey Rosenfield, the author of Proposition 103. “Instead of enforcing those protections when they are needed most, the Insurance Commissioner has capitulated to the insurance industry demands, which will dramatically increase homeowner and renter insurance bills by hundreds or even thousands of dollars. Note that Lara did not disclose the purported industry ‘agreement’ that is the quid pro quo for this giveaway, that was obviously developed with insurance industry lobbyists behind closed doors.

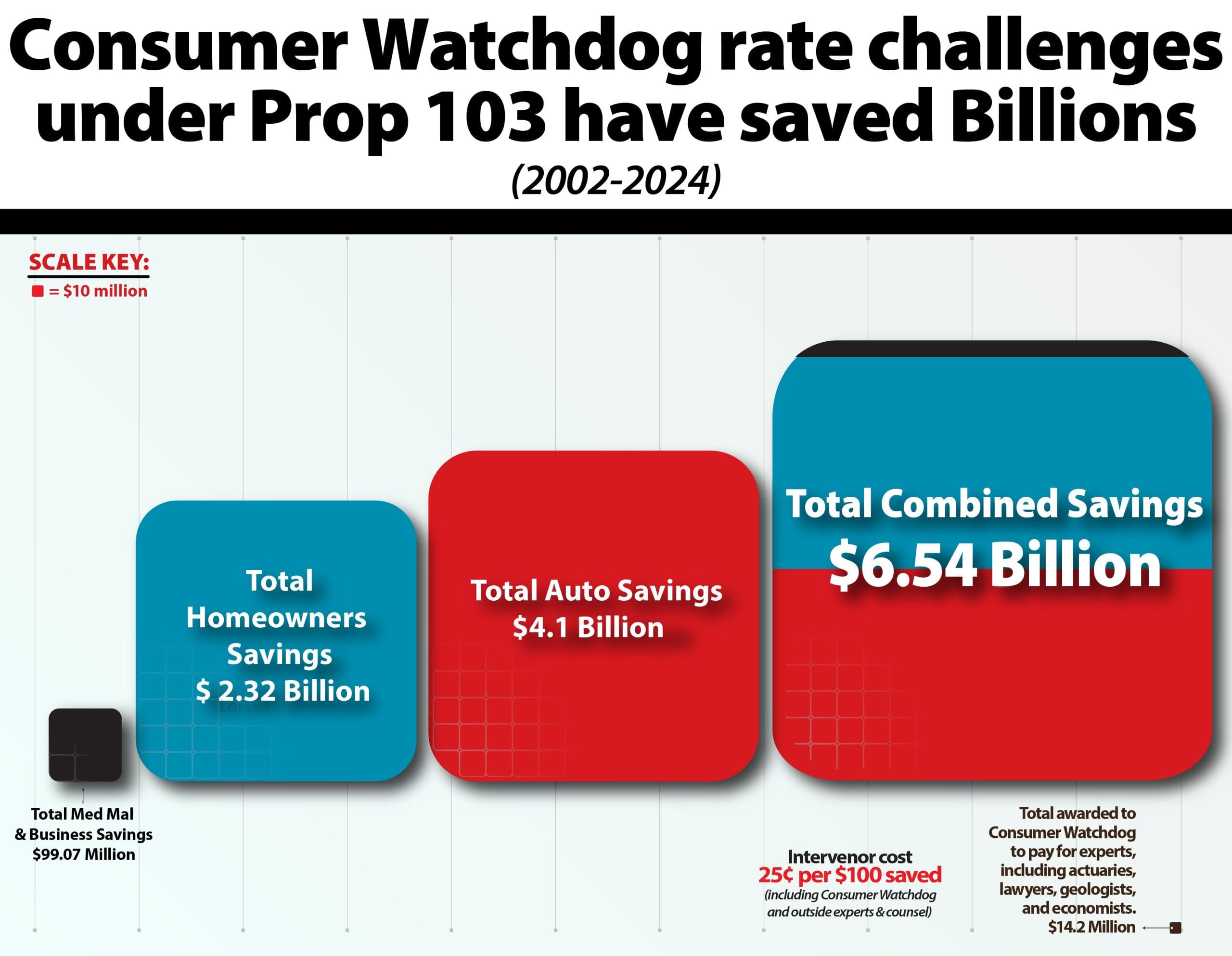

“Consumer Watchdog will not allow Lara to derail the right of consumers to challenge the insurance companies or the Department, under which Consumer Watchdog has saved Californians over $3 billion over the last twenty years. We will carefully monitor the Commissioner’s and his agency’s actions, and, as we have for decades, defend and protect the rights of California voters. In our democracy, their decisions cannot be second-guessed,” Rosenfield concluded.

“The use of catastrophic modeling and adding of reinsurance costs to premiums has pushed Florida premiums up 2 to 3 times higher than California’s” said Jamie Court, president of Consumer Watchdog. “California is in danger of becoming Florida with these changes that mimic the failed strategies in the Florida. Lara has given into the industry’s demands and the consumers are going to be paying the bills for a long time unless he is stopped.”