Consumer Watchdog executive director Carmen Balber testified on March 12, 2025 to the State Senate Insurance Committee about the state of the insurance market after the L.A. Fires.

Climate change has driven up disaster risk, and we must urgently respond to make California safer by strengthening neighborhoods’ wildfire resilience, building back better, and having tough conversations about where it may be too risky to expand in future. But the L.A. Fires do not show that California is no longer insurable.

On the contrary, they show the insurance industry is well-positioned to pay for the fire damage we face today because insurers are doing far better financially than they would have us believe. Insurance companies have been raking in premiums paid diligently by consumers for decades, and rate hikes intensified in California and across the country in recent years as insurance companies prepared for just such a disaster. This is what insurance is here for and every private insurance company in the state has said it has the resources to pay its L.A. Fire claims.

Financial information reported by insurance companies to the National Association of Insurance Commissioners makes the industry’s financial health clear. Nationally, insurance companies are holding a record-high surplus of more than $1.1 trillion dollars.[1]

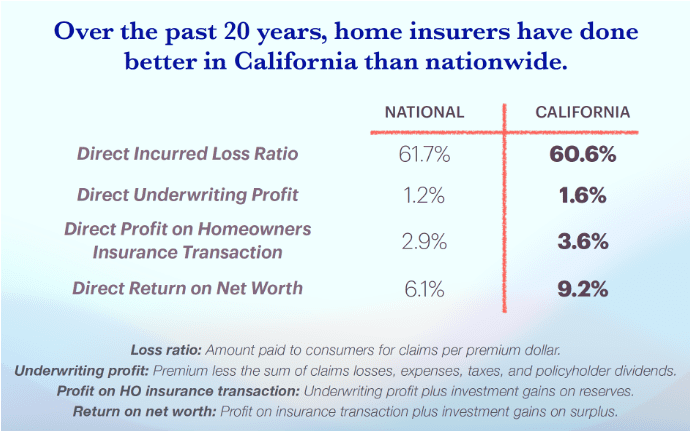

And in California home insurance companies have been more profitable over the last two decades than home insurers nationwide. The companies’ direct return on net worth – a profit measure that includes premiums collected, claims paid, and critically the

investment income where insurance companies make their real money – was three percentage points higher in California than it was nationally, 9.1 percent to 6.2 percent. (This data was also collected from the industry by the NAIC.)[2]

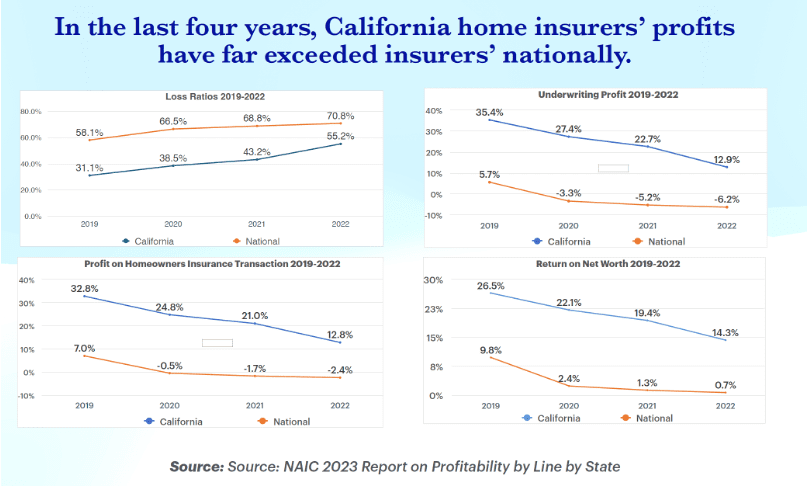

California did even better in recent years,[3] with return on net worth reaching 14.3 percent in 2022, compared to 0.7 percent on average nationally.

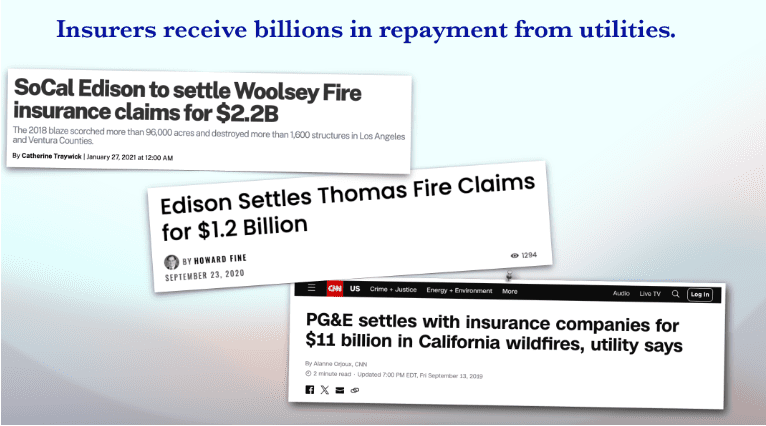

California insurers paid out a lot for the serious fires of 2017 and 2018. What is much less talked about is that they were repaid billions by the utilities for a large part of those losses. PG&E alone repaid insurers over $11 billion in subrogation payments. SoCal Edison repaid over $4 billion. Based on initial evidence Edison’s role in starting the Eaton fire will require the utility to pay insurers even greater subrogation reimbursements.

Insurance companies face real cost pressures: inflation, rising construction and labor costs, more destructive climate-related disasters, supply chain problems, and big Wall Street losses after the pandemic. However, these problems are not unique to California. Consumers from Iowa to New Jersey, and Colorado to Louisiana, can testify to paying more and having a harder time getting insured.

Insurance companies claim that regulation in California prevents them from making enough money and is to blame for the insurance crisis. As the profit numbers show, that too is false.

California’s strongest-in-the-nation insurance oversight law, Proposition 103, isn’t price caps. It created a prior approval system that requires insurers to open their books, justify prices, and get the insurance commissioner’s approval before rate increases take effect. The law mandates full transparency of everything that impacts prices so we can all check insurance companies’ math. And it allows members of the public and groups like Consumer Watchdog to participate in rate review to keep the companies honest.

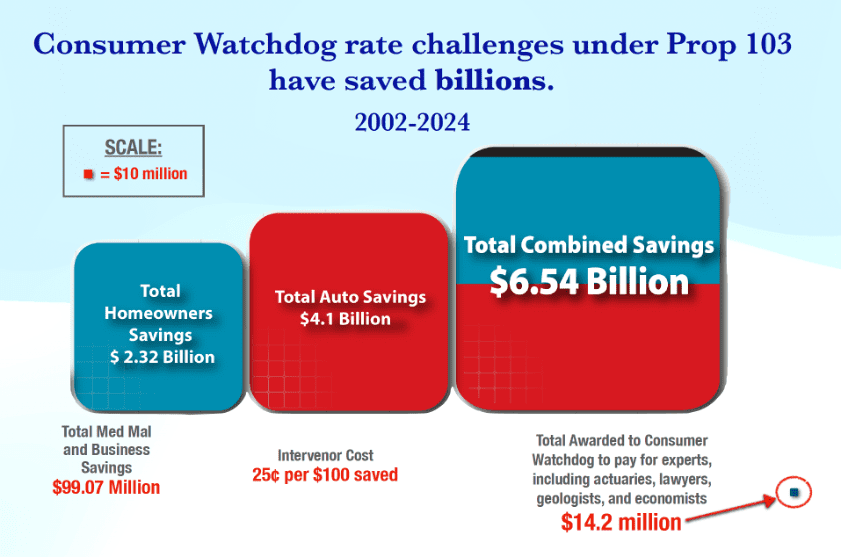

According to the Consumer Federation of America Prop 103 has saved consumers billions of dollars since it was enacted – $154 billion on auto insurance alone.[4] Consumer Watchdog has used the public participation process to directly challenge insurer proposals for excessive rate hikes and save $6.5 billion on auto, home and small business insurance over the last twenty-two years.[5]

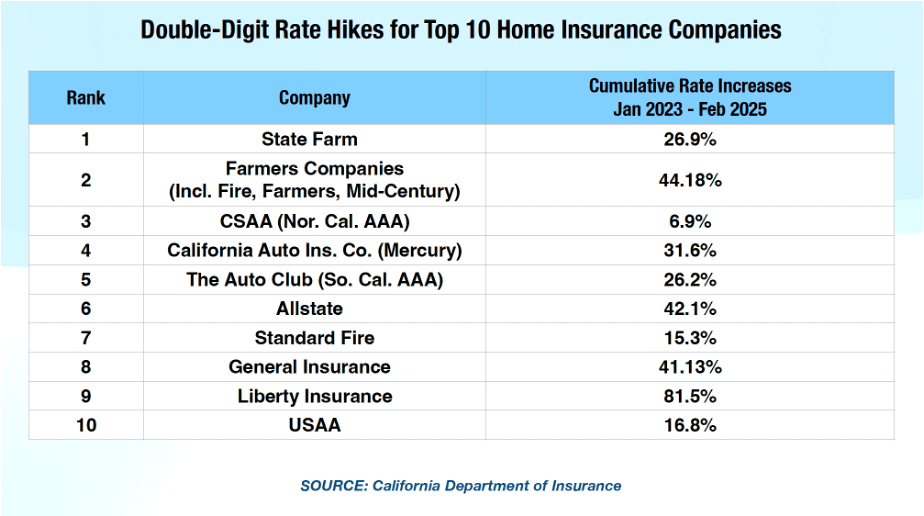

At the same time, Prop 103 has allowed home insurance companies to get the rate hikes they need to cover legitimate cost increases. Companies often suggest they can’t ask for more than 7%. In fact, over the past two years nine of the top ten home insurance companies in California received double-digit rate increases. Some of them received several. Homeowners in fire areas paid much more, as rate increase numbers represent averages across the state.

Nevertheless, insurance companies have used the reality of climate change and other cost pressures to push the deregulation they’ve wanted for decades.

Insurance Commissioner Lara’s Sustainable Insurance Strategy enacts the deregulation the insurance industry sought. These changes will raise rates dramatically for consumers in the coming year but are not improving consumers’ access to coverage.

The rules limit rate oversight and will allow insurance companies to use private catastrophe models—secret, unaccountable algorithms—in order to raise premiums.[6] Because the private modeling companies refuse to disclose the data, inputs and methodologies they use to predict fire risk, regulators and the public are left unable to test the veracity of their projections.

The nonprofit CarbonPlan recently compared predictions by two different catastrophe models of California wildfire risk. Each model found risk would increase at about a third of locations, but they only agreed on which location in 12 percent of spots.[7] A similar Bloomberg comparison found two models’ Los Angeles flood risk projections were the same at just one in five properties.[8] Such extreme variability shows that consistent standards for model review and approval are needed to ensure models’ predictions – and the rate hikes they support – are accurate and fair. The commissioner’s regulations do not allow for such scrutiny.

The commissioner announced last summer he would put consumers on the hook for bailing out insurance companies when the FAIR Plan can’t pay its bills, and invoked that bailout in the wake of the L.A. Fires.[9]But homeowners are on the FAIR Plan because the private insurance industry has abandoned them. By statute, insurance companies share in FAIR Plan profits and losses. Insurers gained when the FAIR Plan did well. They should not be allowed to shirk responsibility out when their actions cause a FAIR Plan assessment.

The commissioner’s new rules will also allow insurers to charge consumers for the global, unregulated costs of the reinsurance they buy themselves.[10] The Department of Insurance has never before allowed home insurance companies to pass through reinsurance spending to consumers because reinsurance is unregulated through the prior-approval process and reinsurance contracts are not open to public scrutiny.

A report issued by the Department of Insurance in 2018 noted that insurers purchase their reinsurance coverage from non-admitted carriers and from their own affiliates for what may or may not be market pricing. “To allow insurers to load unregulated reinsurance costs into the consumer’s premium rate potentially undermines the entire prior-approval process and would increase costs for all insurance consumers.”[11]

Commissioner Lara did not release any analysis of the premium impact of adding black box catastrophe models or reinsurance to consumers’ insurance bills, and the reinsurance rules were filed without even an opportunity for public comment. However, the experience of other states that allow insurers to charge consumers for the cost of reinsurance shows us that it consistently adds 30-50% to insurance rates.

- Former insurance regulator, actuary and consumer advocate Robert J Hunter provided testimony to the legislature that allowing insurers to charge consumers for reinsurance could increase premiums by 40% overnight and cause periodic reinsurance-driven spikes in premiums of 50% or more.[12]

He noted a report from Florida regulators, where the cost of reinsurance accounted for 40-50% of premiums in 2004 and 2005. Hunter was the Federal Insurance Administrator under Presidents Ford and Carter, a Texas Insurance Commissioner and the Director of Insurance at the Consumer Federation of America.

- According to documents filed by the insurance industry in a recent North Carolina homeowners insurance rate filing, adding the net cost of reinsurance increased the rate companies sought by 46%.

- And a June 2024 study that used mortgage data to compare insurance premiums across states found an average 33% increase in premiums due to the pass-through of reinsurance costs in states with the most disaster risk.[13]

The situation with State Farm is a poster child for why strong rate oversight by the commissioner and public participation under Prop 103 are so important for keeping prices honest in California.

Consumer Watchdog is a formal intervenor in the “emergency” 22% rate hike request State Farm sought in February. The company has failed to justify its demands but wants policyholders to pay now and ask questions later. The limited information available makes a strong case against making California homeowners bail it out for its mismanagement.[14]

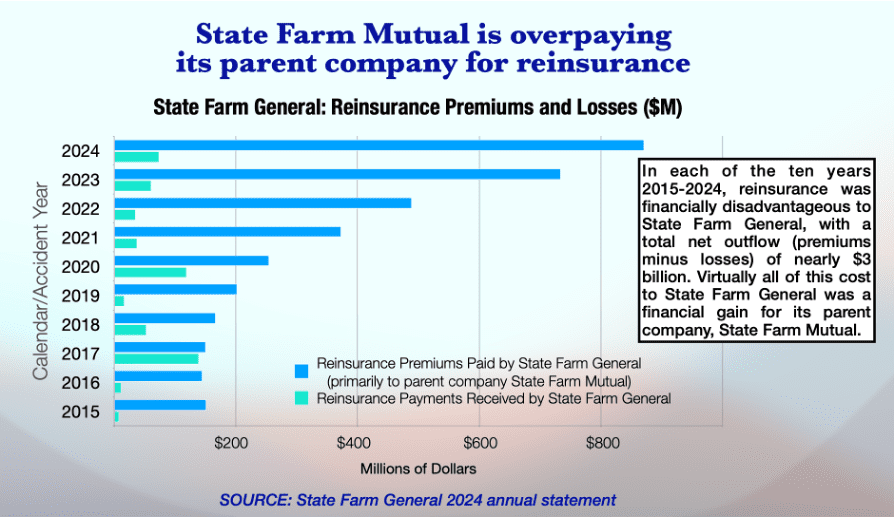

The top of the list is State Farm General’s questionable reinsurance deal. Unike most companies, State Farm General buys most of its reinsurance from its parent company in Illinois. But for the last decade, State Farm’s payments to its parent company for reinsurance benefited the parent, not California policyholders.

From 2015-2024 State Farm lost money on its reinsurance agreements every year —including during the severe wildfire years of 2017 and 2018 when it paid nearly $5 billion in direct claims.[15] Even in 2017-18, State Farm paid out more for its reinsurance than it recovered. This is markedly different than the experience of other major homeowners insurance companies concentrated in California, all of which received substantial net recoveries from their reinsurance in 2017 and 2018.[16] If reinsurance is for worst case scenarios it should pay out when fires hit. State Farm’s cozy deal with the parent company did not. Even worse, $1 billion in money the utilities repaid State Farm for the 2017 and 2018 fires was sent out of state to the parent company, instead of staying with the subsidiary that is now claiming poverty.

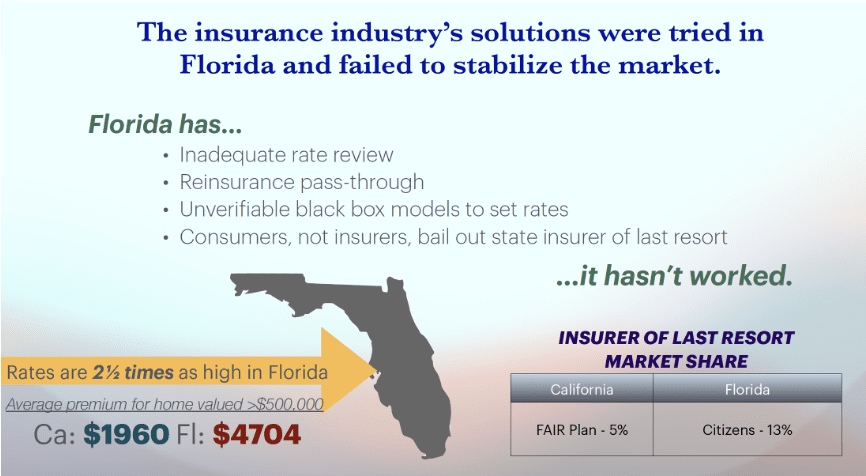

The Commissioner’s Sustainable Insurance Strategy won’t get Californians access to coverage again. We know because it hasn’t worked elsewhere. Other catastrophe-prone states allow insurance companies to use models to predict catastrophe risk, charge consumers for unregulated reinsurance costs, and limit rate oversight. They’re seeing the same access and affordability problems California is.

In Florida, where these concessions to insurance companies have been law for many years, rates are two and a half times as high as California’s, three times as many policyholders are on their version of the FAIR Plan, and insurance companies still left the state. Giving the insurance industry everything it wants doesn’t bring them back into the market.

The Sustainable Insurance Strategy is supposed to contain a quid pro quo for consumers. In return for concessions to the industry that allow insurance companies to raise rates based on opaque models and reinsurance, the insurance commissioner has said that insurance companies will have to increase sales in wildfire areas to 85% of what they sell to homeowners in the rest of the state. In fact, no such requirement exists in the text of the regulation.[17]

Commissioner Lara finally acknowledged at the end of last year that the most his rule requires is a 5% increase in sales in “distressed areas” two years from when an insurer makes such a commitment (late 2027 at the earliest).[18] The baseline year for determining how much a company would increase coverage will be 2024 or later, after insurance companies’ non-renewals and underwriting restrictions decreased the size of their footprint in distressed areas across the state. Insurance companies may also opt for an undefined, “alternative commitment.” After two years, a company may come back to the commissioner and say it could not meet its goals — as long as it claims to be making a “reasonable effort.” The regulation then allows the company to move the goalposts without consequences.

This means that nothing in the insurance commissioner’s plan is going to get Californians access to affordable coverage again. Deregulation, rate hikes and coverage restrictions are a good way to line insurance companies’ pockets but won’t keep California residents insured. Consumers need more from the legislature.

The number one question we’ve heard from consumers recovering from the L.A. Fires is: Will I get insurance after I rebuild? One sure way to get Californians back into the private market and off the FAIR Plan is to require insurance companies to cover those homeowners whose investments in resilience meet state wildfire mitigation standards and make us all safer. While some may say you cannot require companies to sell coverage, they are wrong. California’s insurance market is the largest in the nation and the fourth-largest in the world. Insurance companies that refuse to insure resilient homes should be barred from California’s profitable auto insurance market as well. There is also long precedent for similar mandates. California is one of a handful of states across the country that requires auto insurance companies to sell to all good drivers. Nationally, the Affordable Care Act requires health insurance companies to sell to all consumers, regardless of pre-existing conditions.

To make mitigation accessible to all Californians, California needs to increase investments in mitigation and require insurance companies to contribute to making our communities safer. We also need statewide standards for community wildfire resilience to match the “Safer From Wildfires” standards we already have for individual homeowners.

We must build a publicly-backed, transparent wildfire risk model so home and business owners – not just the insurance industry – have access to actionable data about their own risk. A non-profit government-run reinsurance program should be created to backstop the worst disasters.

And we must shift the costs of climate change-driven losses away from consumers and back where they belong: Onto the fossil fuel companies whose emissions are making disasters worse. Insurance companies and individuals must be enabled to recoup costs from oil companies, taking pressure off of insurers and the FAIR Plan. And the insurance companies who are propping up fossil fuels by investing in, and underwriting, fossil fuel production and infrastructure must be required to disclose these entanglements and create a path to eliminating them.

Several of these ideas have surfaced in legislation proposed by members of this committee and others. We urge you to support their passage, and to embrace new legislation to require insurance companies sell to those consumers and communities who do the right thing and protect their homes from wildfire. The comments of a State Farm executive who was fired last week after disparaging L.A. wildfire survivors further suggest that State Farm is using threats of non-renewals to squeeze rate hikes out of the state and that insurance companies won’t stick around in some areas without a mandate to do so.[19]

What we should not do is allow the insurance industry to decide where Californians can or cannot live. Residents of the Palisades, Altadena, and all of the impacted L.A. communities were told it was safe to live where they do for decades. When generational wealth, family and financial interests all root people in a community, we cannot allow the insurance industry to declare a community unlivable overnight, especially when the industry remains profitable. Those who think that with the right price signals from the insurance industry Americans will move out of places now threatened by climate change fundamentally misunderstand why we live where we do.[20]

We need look no farther than the insurance industry’s $500 billion in fossil fuel investments, and continued underwriting of the fossil fuel projects that contributed to the conditions that sparked the L.A. Fires, to see that industry decision-making prioritizes short-term profits over sustainable community solutions to the climate threat.

[1] https://content.naic.org/sites/default/files/pc-and-title-2024mid-year-industry-report.pdf

[2] https://content.naic.org/sites/default/files/publication-pbl-pb-profitability-line-state.pdf

[3] https://newrepublic.com/article/190048/california-insurance-los-angeles-fires

[4] https://consumerfed.org/wp-content/uploads/2019/02/auto-insurance-regulation-what-works-2019.pdf

[5] https://consumerwatchdog.org/wp-content/uploads/2025/01/Prop103-SavingsAndFees-Chart-1-25.pdf

[6] https://consumerwatchdog.org/insurance/secret-algorithms-to-raise-home-insurance-rates-no-requirement-for-new-coverage-under-lara-regulations-issued-today/

[7] https://carbonplan.org/research/climate-risk-comparison

[8] https://www.bloomberg.com/graphics/2024-flood-fire-climate-risk-analytics/

[9] https://consumerwatchdog.org/insurance/homeowners/

[10] https://consumerwatchdog.org/insurance/lara-reinsurance-regulation-to-pump-up-homeowners-rates-by-40-without-guarantees-of-new-wildfire-coverage-no-opportunity-for-public-input/

[11] https://www.insurance.ca.gov/0400-news/0100-press-releases/2018/upload/nr002-2018AvailabilityandAffordabilityofWildfireCoverage.pdf

[12] https://consumerwatchdog.org/insurance/national-insurance-expert-warns-ca-bill-deregulate-homeowner-insurance-will-hike-rates-40/

[13] https://www.nber.org/papers/w32579

[14] https://consumerwatchdog.org/in-the-courtroom/consumer-watchdog-opposes-state-farms-emergency-rate-hike-following-meeting-with-insurance-commissioner-lara/

[15] https://consumerwatchdog.org/wp-content/uploads/2025/02/2025-02-26-Memo-to-Lara-and-Parties-re-SFG-Emergency-Interim-Rate-Request54.pdf

[16] https://consumerwatchdog.org/insurance/state-farms-shady-reinsurance-deal/

[17] https://consumerwatchdog.org/wp-content/uploads/2024/09/2024-09-17-Consumer-Watchdog-Catastrophe-Modeling-Rulemaking-Comments.pdf

[18] https://consumerwatchdog.org/in-the-news/the-washington-post-california-will-force-insurers-to-cover-fire-prone-areas-but-rates-will-rise/

[19] https://consumerwatchdog.org/in-the-courtroom/watchdog-to-lara-state-farm-execs-startling-admission-about-orchestrating-rate-hike-request-through-cancelled-coverage-should-be-disqualifying-for-emergency-request/

[20] https://climateandcommunity.org/research/premium-price-increases/