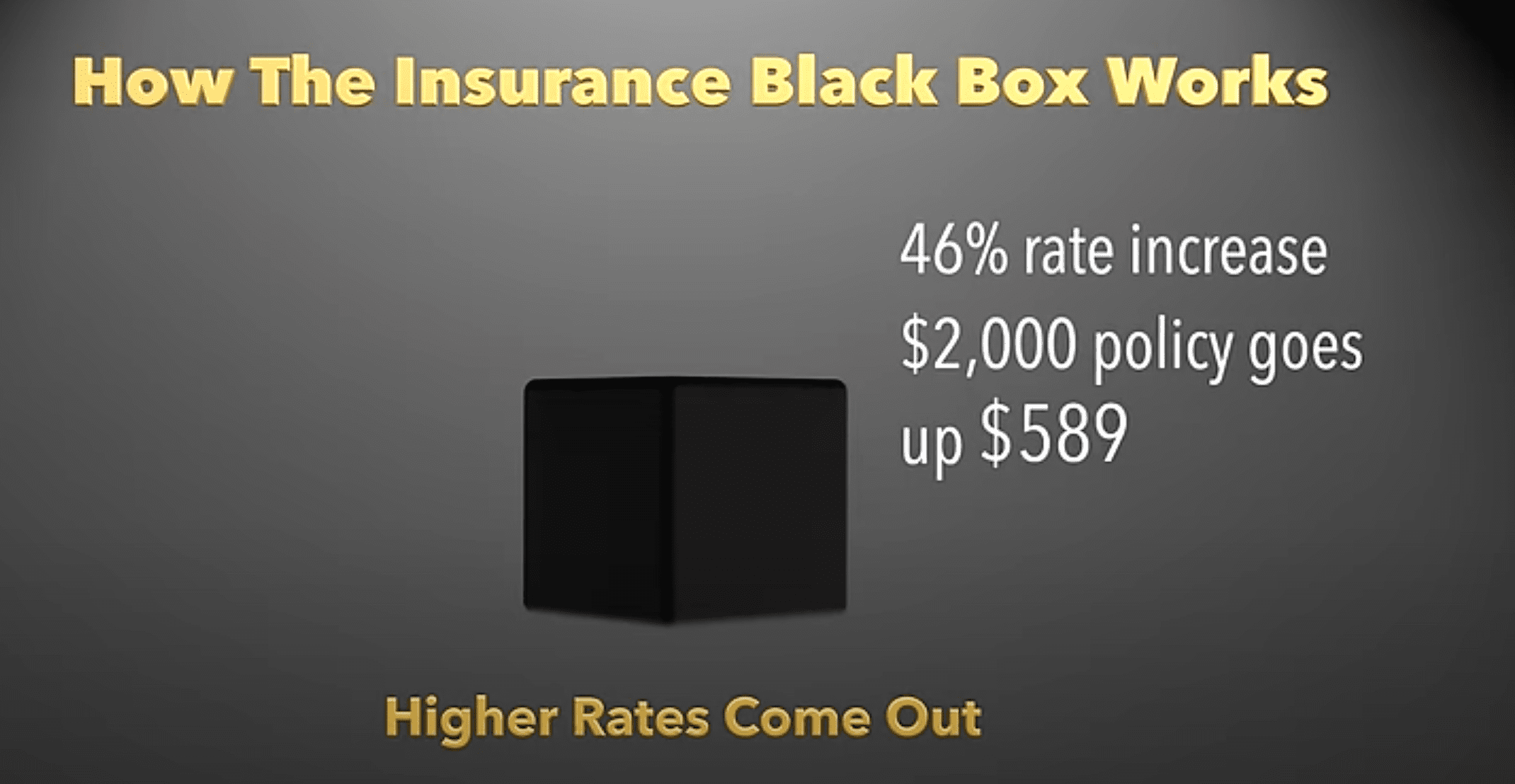

Los Angeles, CA – Consumers should expect large rate hikes but not more insurance policies sold under new rules issued by Insurance Commissioner Ricardo Lara and finalized by the Office of Administrative Law today, said Consumer Watchdog. The rules gut the transparency at the heart of California’s insurance consumer protection law, Proposition 103, by allowing insurers to use secret calculations from black box models to set rates.

The Insurance Commissioner claims that insurance companies will have to cover more homeowners in wildfire areas in exchange for the right to raise rates with secret algorithms. However, this requirement is not in the text of the regulation. Instead, insurance companies won the right to keep how they project wildfire losses secret, meaning the public and regulators will have no way to determine if wildfire insurance rates are fair.

“Full transparency is what keeps insurance rates honest but Commissioner Lara’s rule does away with that protection. The rule will let insurance companies raise rates based on secret algorithms but not expand coverage as promised,” said Carmen Balber, executive director of Consumer Watchdog.

The rules violate insurance consumer protections under Proposition 103 that allow regulators and the public to confirm rates are justified. Lara claimed the rule is exempt from review by the Office of Administrative Law (OAL). Consumer Watchdog urged the OAL to reject that claim and to review the regulations for consistency with state insurance laws as required by the Administrative Procedures Act (APA). Read Consumer Watchdog’s letter.

“Particularly now, when the insurance industry has fomented insurance shortages across the state and is threatening further widespread economic disruption unless Commissioner Lara rolls back current regulatory requirements, it is crucial that the APA’s bedrock protections against arbitrary government action be respected,” wrote Consumer Watchdog staff attorney Ryan Mellino in the letter.

It is the latest example of Insurance Commissioner Lara rejecting independent oversight of his actions. At a hearing happening now in Los Angeles Chief Administrative Law Judge for the Department of Insurance is addressing the Insurance Commissioner’s attempt to limit judicial oversight in rate cases. Read Consumer Watchdog’s public comment (opens in new tab).

Insurance Commissioner Lara promised insurance companies will have to cover 85% of homeowners in wildfire areas in exchange for the right to raise rates using secret models. However loopholes in the regulation allow all insurance companies to say they will increase coverage in fire areas by just 5%, not the 85% coverage the commissioner has promised (watch the KGO story (opens in new tab)). Or they may opt for a third, undefined, “alternative commitment”. After two years, the regulation allows insurers to move the goalposts if they don’t meet their commitments.

“This giveaway to the insurance industry won’t get Californians access to the home insurance they need. Lawmakers must step in and require insurance companies to cover those Californians who meet state standards and make their homes safe from wildfires,” said Balber.

The Insurance Commissioner ignored testimony by consumer advocates in public workshops concerned with the secrecy of the model review process, lack of minimum disclosures, lack of any technical standards for models, and the lack of accountability for how algorithms will impact rates.

Read Consumer Watchdog’s testimony outlining how the regulation guts the transparency, standards and robust oversight that are needed to ensure consumers pay fair insurance rates and are required under Proposition 103 here:

September 17, 2024

June 26, 2024

April 23, 2024

Among the other loopholes in the regulation’s “insurer commitment” sections:

- Insurance companies won’t have to sell comprehensive coverage. They may offer a bare-bones policy equivalent to what consumers get today on the FAIR Plan.

- Rate hikes start on Day 1, but insurers won’t report progress toward commitments for two years – until at least 2027.

- After two years, an insurer may put off meeting a commitment indefinitely, as long as it claims to be making a “reasonable effort.”

- There are no penalties if a company fails and no timelines for completion.

Among the regulation’s failures to require any meaningful oversight of black box models and their impact on rates:

- Creates a process designed to keep models and their algorithms private, violating Prop 103’s public disclosure requirements.

- Does not require wildfire models be proven reliable, predictable and unbiased.

- Contains no guidelines for minimum information to be made public; required disclosures will be different for every model.

- Actively discourages public participation and expert review of models.

- Makes the whole process voluntary, and any model currently in use is exempted from review for years.