Annual reports for State Farm’s home insurance subsidiary in California suggest it’s sending profits out of state by overpaying its parent company for reinsurance. California policyholders shouldn’t have to foot that bill. Read the Los Angeles Times story.

From 2014 to 2023 State Farm paid reinsurance premiums of nearly $2.2 billion, but was only reimbursed $0.4 billion – or less than 20%. The vast majority of this was bought from State Farm’s parent company or affiliates. A reinsurance return that low is a strong indication that the company is overpaying.

What is reinsurance? Think of it as insurance for insurance companies. Insurers buy reinsurance to reimburse them for some of their biggest losses. That means that in most years it isn’t expected to pay out very much. But in the years with the biggest losses, it’s supposed to pay out a lot.

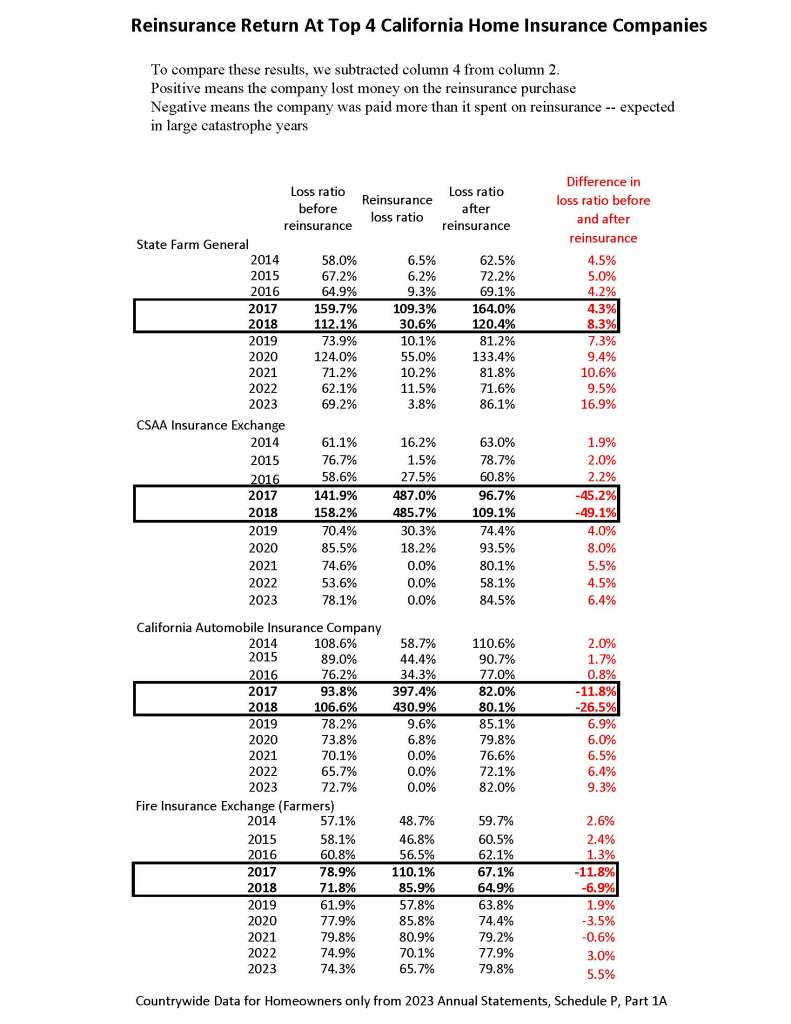

In 2017 and 2018 California experienced catastrophic wildfires – the kind of extreme weather event reinsurance is meant to protect against – but State Farm’s financial results would have been better if it had just kept all of the risk in-house and not purchased reinsurance.

The global reinsurance market is unregulated, and insurance companies don’t disclose the terms of their contracts. So, to get a better sense of just how bad a deal State Farm is getting on reinsurance, we compared State Farm’s financial results to the next three largest home insurers in California.

According to the annual reports for CSAA (Northern California AAA), CAIC (a Mercury company), and Fire Insurance (a Farmers company), all three got more bang for their buck in their reinsurance deals. Notably, each company did markedly better due to the reinsurance coverage they purchased for the 2017-18 fire years than they would have without it, in contrast to State Farm.

Even though we know they did better than State Farm, we don’t know the terms of CSAA, CAIC, and Fire Insurance’s reinsurance contracts. We do know that State Farm is getting a terrible deal in comparison to its competitors, and that its parent company benefits.

That’s Exhibit One for why consumers should not pay for unjustified reinsurance costs. But that’s Insurance Commissioner Ricardo Lara’s plan: to allow insurance companies to charge consumers for the cost of the unregulated reinsurance they purchase.

These large reinsurance purchases have reduced State Farm’s surplus, and the insurance company is using that as an excuse for seeking a massive 30% increase to California homeowners’ insurance rates. This is after already imposing two rate increases totaling 27% over the last year.

Consumer Watchdog has challenged the latest rate hike request under the public participation process created by Proposition 103, citing, in part, the company’s reinsurance payment imbalance.