Santa Monica, CA — San Bernardino County, plagued by predatory mortgages that left 60% of the county’s homeowners underwater, is stepping up to solve the problem on its own after the failure of banks and the financial industry to stem the crisis, said Consumer Watchdog. The county’s newly formed joint powers authority scheduled a vote today to develop a request for proposals seeking partnerships to preserve home ownership and help save communities ruined by run-down foreclosed homes.

“San Bernardino County hasn’t fired a shot yet at the financial and securities industries that made billions on risky and often predatory loans and left homeowners to drown, but it is unsheathing its big weapon and taking aim,” said Jamie Court, president of Consumer Watchdog. “It’s a gutsy move by a locality whose homeowners are mired in debt and sinking the county economically.”

The county body’s plan to request proposals is broadly and blandly worded, aiming to “preserve home ownership” and “enhance the economic vitality” of neighborhoods. But an idea that has been publicly discussed is using the county’s eminent domain powers to seize thousands of underwater mortgages and help owners refinance at their current fair market value. The financial and securities industries have reacted to the idea with fury, even threatening to shut down lending and bond issuance in localities that take such a step.

See the authorization for development of request for proposals here: http://cob-sire.sbcounty.gov/sirepub/cache/2/tp2gez55in30ylrmkrlvmwzc/154059508162012092153595.PDF

See news report on eminent domain proposal here: http://www.nytimes.com/2012/07/15/us/a-county-considers-rescue-of-underwater-homes.html?_r=1&pagewanted=all

“Every part of the financial industry has gotten a bailout to keep companies from going under in the economic meltdown, and the only sector left out was consumers and cities that are still sinking,” said Court. “Consumers should cheer on localities that are ready to bail themselves out of a foreclosure crisis that is not going away.”

County officials have told Consumer Watchdog that they seek a variety of proposals, and that eminent domain seizures are only one idea under discussion. Yet the mere airing of the idea by a locality takes it out of the realm of academic study and into the embattled arena of the foreclosure crisis.

“The financial industry and federal government have utterly failed the hardest-hit cities and counties,” said Judy Dugan, research director for Consumer Watchdog. “The fastest way to stop the economic crisis in areas like San Bernardino County is to reduce the amount owed on homes that are often worth less than 50% of their mortgage amount. Even mortgage investors would be better off in the long run by taking a loss now and stabilizing housing and local economies, rather than letting homes fall to ruin in foreclosure.”

The city of San Bernardino recently declared bankruptcy, in large part because of its foreclosure crisis.

Simply by moving toward independent action of any kind, San Bernardino County and other localities considering local solutions should grab the attention of the industry, Congress and the White House. President Obama, for instance, whose own nominee to head the Federal Housing Finance Administration has been blocked by Congress, should make a so-called recess appointment to the post at the first opportunity to replace FHFA head Edward DeMarco, said Consumer Watchdog.

De Marco, the current overseer of millions of home loans guaranteed by Freddie Mac and Fannie Mae, has refused to reduce principal amounts on underwater loans despite numerous studies finding far greater public economic benefits in principal reduction than in foreclosure.

“Simply by having the courage to take on the monster that is killing its cities, San Bernardino County will send a message that cannot be ignored to Washington,” said Court. “Homeowners, cities and whole states that have begged to no avail for real help against foreclosure may find more ears in Washington that will listen.”

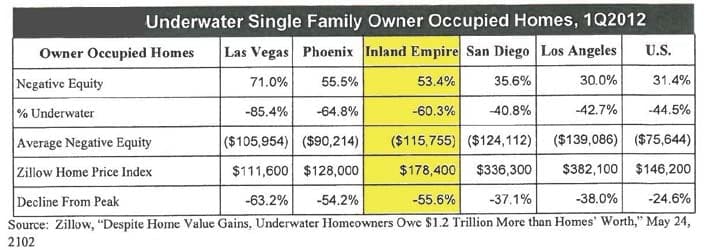

See a chart of the Inland Empire region’s position among the localities hardest-hit by foreclosure here:

– 30 –

Consumer Watchdog is a nonprofit, nonpartisan consumer advocacy organization with offices in Santa Monica, CA and Washington, DC. Learn more at http://www.ConsumerWatchdog.org