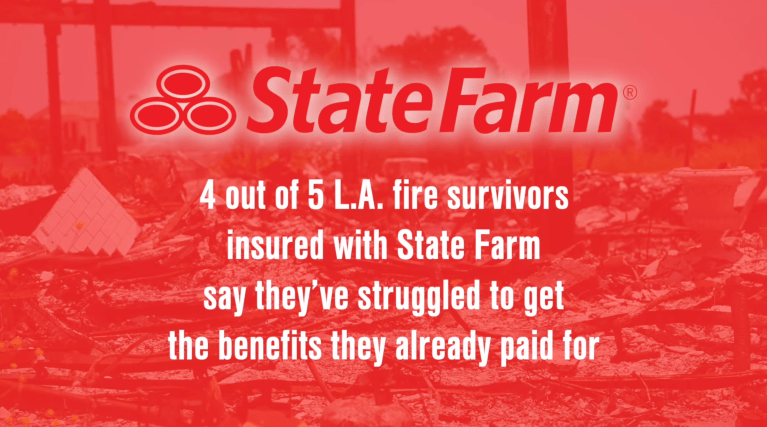

Los Angeles, CA — One year after the Los Angeles fires, Consumer Watchdog released the final report in a three-part series investigating how large insurance companies underpay wildfire survivors through a combination of industry-aligned subcontractors, black box technology, and outright illegal denials.

“We examined court records, contracts, interviewed experts, attorneys and fire survivors to cut through the corporate narrative and weave a compelling story from the perspective of policyholders,” said Consumer Watchdog’s Justin Kloczko.

These are the following reports:

How Technology Shapes Property Insurance

Reveals how hidden algorithms and artificial intelligence used by the nation’s largest home insurance companies are leaving many homeowners underinsured, underpaid, or denied home insurance completely. And how one large technology company sells the products that shape policy limits, construction costs, a home’s fire risk score, and how much insurers can charge for future disasters.

Uncovers a troubling system of supposed testers and cleaners hired by insurance companies, who often prioritize minimizing payouts over restoring fire survivors’ homes to safe and livable conditions.

Lowball: What Fire Survivors Want You To Know About Insurance Claims

Ten practical tips for getting smoke claims paid directly from fire survivors. As thousands of policyholders navigate the home insurance claims process in California following the Eaton and Pacific Palisades fires, many whose homes are still standing are finding out that insurance providers aren’t paying for damage wrought by heat and smoke.

Listeners can also dive into Smoke & Mirrors, our ongoing investigative podcast series about fire survivors and the insurance industry. The series includes narrative storytelling, interviews with experts and attorneys, and draws on court records to paint an immersive picture of how many of the biggest insurance companies are not meeting their obligations to policyholders.

Listen to it on Apple, Spotify and YouTube below: