Los Angeles, CA — As a UN panel finds the world is losing the war with global warming and urgent action is needed, US insurance companies have reported holding more than $50.9 billion in fossil fuel investments that exacerbate climate change, according to reporting to national insurance regulators.

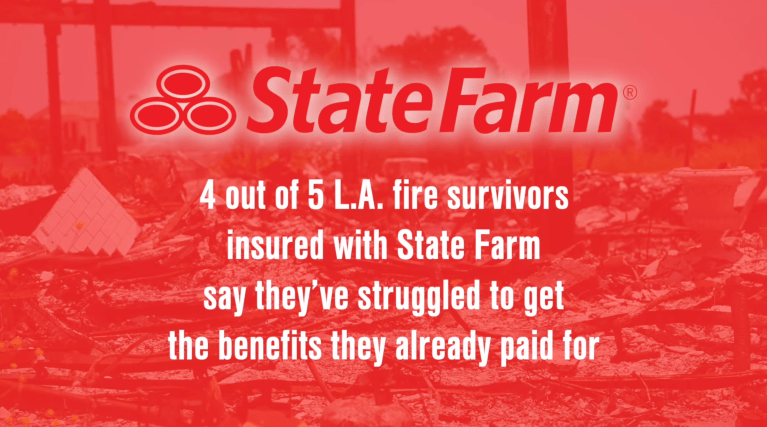

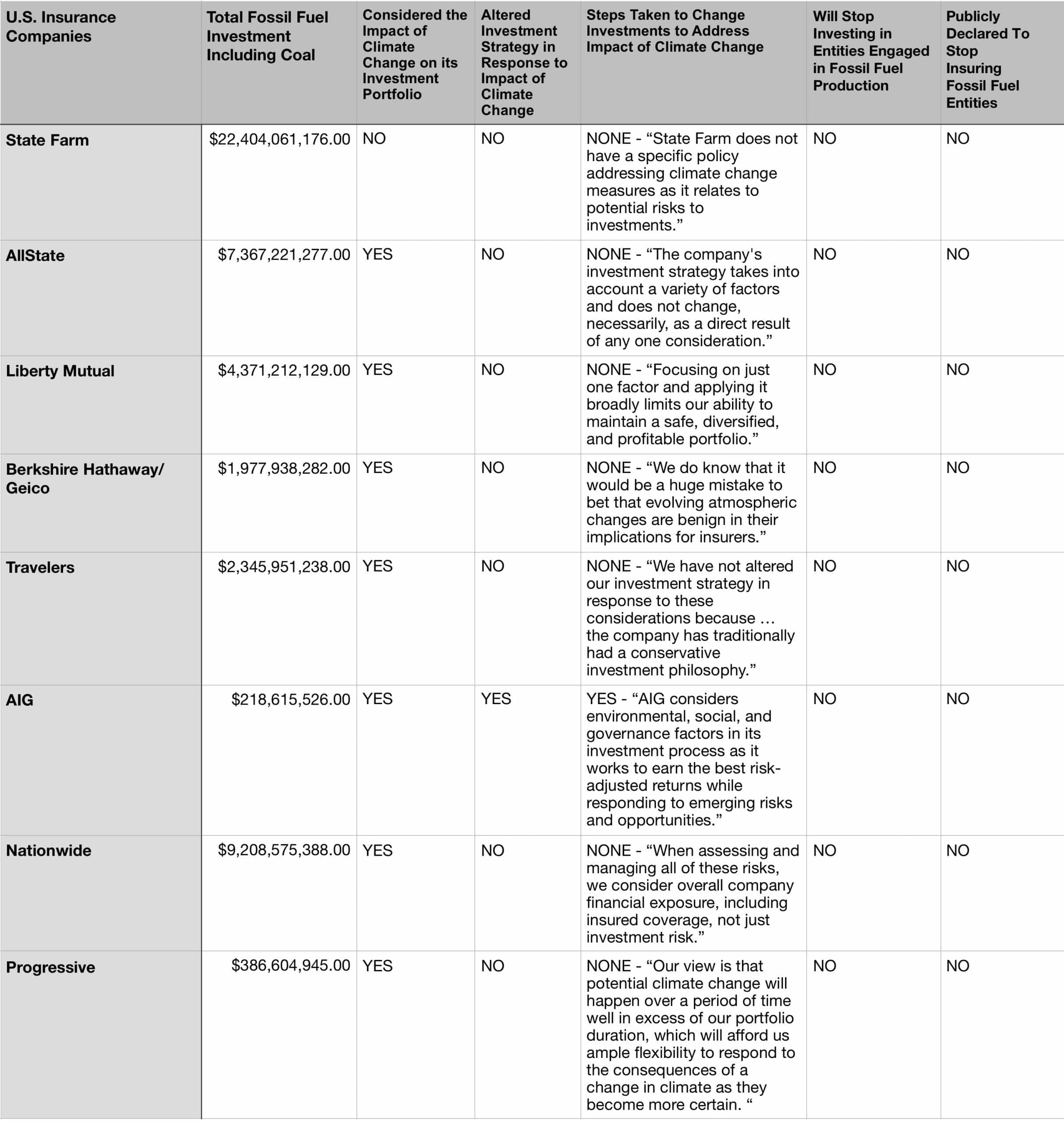

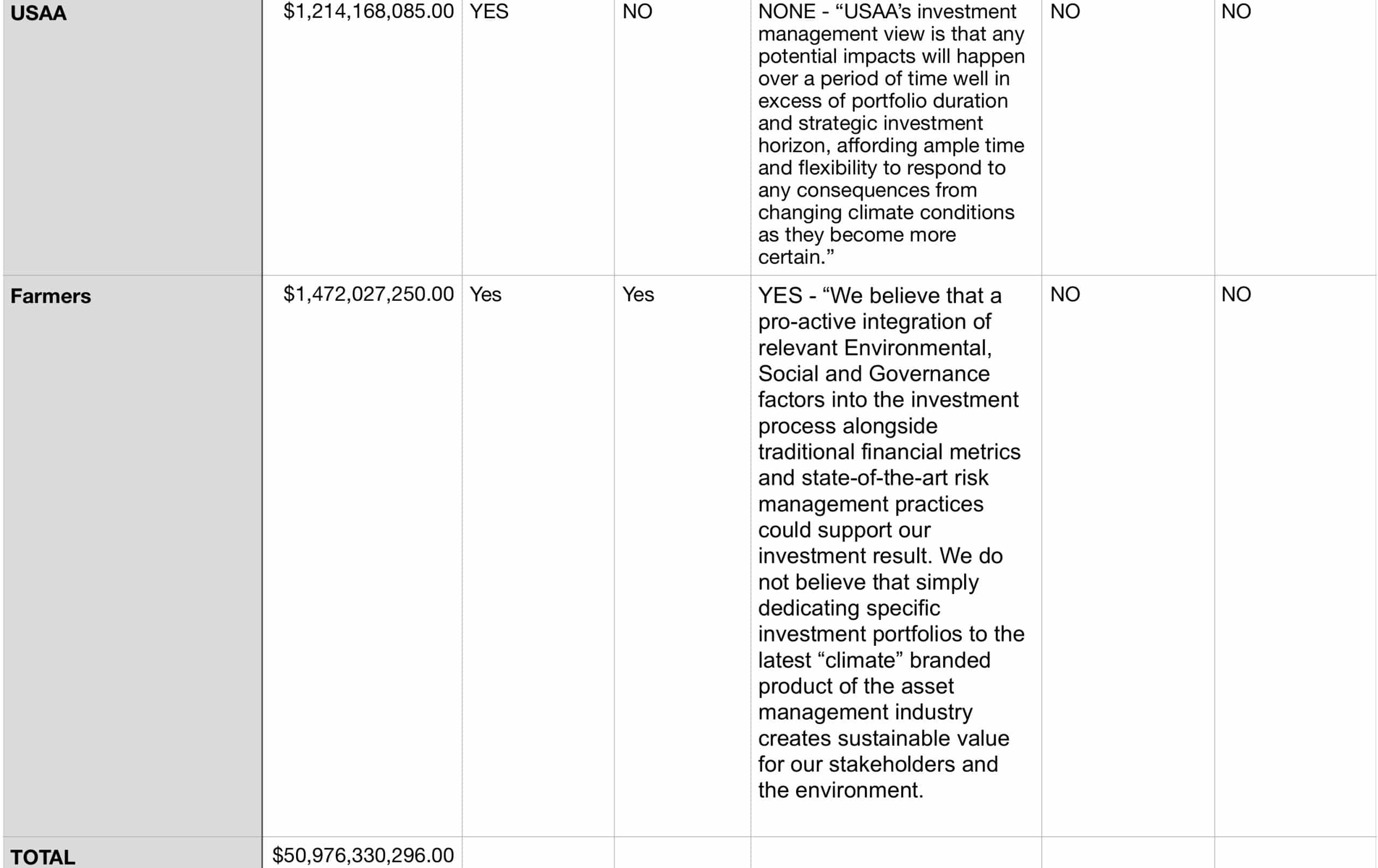

Consumer Watchdog’s review of public filings reveals nine of the 10 largest American insurance companies have considered the impact of climate change on their investments, but only two, AIG and Farmers, say that they have altered their investment strategy in response.

The analysis comes in wake of findings by the U.N. Intergovernmental Panel on Climate Change (IPCC) that “unprecedented” actions will be needed to cut carbon emissions over the next decade to avoid climate warming past the point of no return.

America’s biggest company, State Farm, did not even consider the risk of climate in its investments and holds $22.4 billion in fossil fuel investments.

“Insurance companies’ response to climate change should be to side with the victims, not support the perpetrators,” said Jamie Court, president of Consumer Watchdog. “What if hospitals sold crack, doctors offered cigarettes in their waiting rooms, and firefighters gave out flamethrowers? Insurance companies are paying unprecedented claims because of global warming, they need to be part of the solution if the UN’s call to action is to be realized.”

A chart of the Top 10 companies is below and downloadable.

Insurance companies disclosed the investments and policies in the climate-risk disclosure survey to the National Association of Insurance Commissioners (NAIC). Consumer Watchdog noted that the self-reported fossil fuel investment figures have likely been understated when comparing the number to other surveys.

The 8 Top-10 US insurance companies who do not consider climate change in their investments are State Farm, Allstate, Liberty Mutual, Berkshire Hathaway/Geico, Travelers, Nationwide, Progressive, and USAA.

Only one U.S. insurance company, Lemonade, has taken the pledge to get off fossil fuels. By contrast, top European insurance companies have gone the other way and are ditching the fossil-fuel industry.

Seventeen insurers, mostly European, with assets of at least $10 billion each have divested from coal. Six of the world’s biggest insurers — Allianz, AXA, Munich Re, SCOR, Swiss Re and Zurich — have limited or ceased their insuring of coal projects. AXA and Swiss Re have also limited their underwriting of tar sands projects.

“It’s worth looking at the hypocrisy of California’s insurance industry one year after one of the worst fires in history the Tubbs fire,” said Court. “ Last year’s wildfires produced $12.7 billion in insured losses for the industry alone due to unprecedented fires precipitated by global warming, yet the industry invests in and insures the coal and other fossil fuel projects that are exacerbating climate change.”

Drier conditions are fueling unprecedented wildfires like Tubbs, the third deadliest in California history, as well as mudslide, levee and dam damage. Warming ocean waters create more severe hurricanes.

“The insurance industry is the one global entity that can affect fossil fuel infrastructure,” said Consumer Watchdog counsel Michael Mattoch. “Extreme fossil fuel projects — ones that involve energy-inefficient and ecologically-dangerous coal, tar sands and Arctic drilling, such as the Keystone XL — cannot go forward without insurance.”

Consumer Watchdog said insurance companies’ approach to catastrophic fires is increasingly not to sell insurance in fire areas, to raise rates or not to sell adequate replacement costs coverage. Meanwhile, they keep insuring the extreme fossil fuel infrastructure that makes catastrophic fires more catastrophic.

A new coalition of public-interest groups, Insure Our Future, has called on America’s insurance companies to follow their European cousins and divest from coal and tar sands companies, and to make plans to stop underwriting extreme fossil fuel projects. Read more at www.insureourfuture.us

“Insurance companies should not be betting against their policyholders,” said Mattoch. “California’s insurance commissioner has been at the forefront of raising the issue, but he hasn’t forced the companies to disclose their fossil fuel underwriting and divest. That will be the job of the next insurance commissioner.”

– 30 –