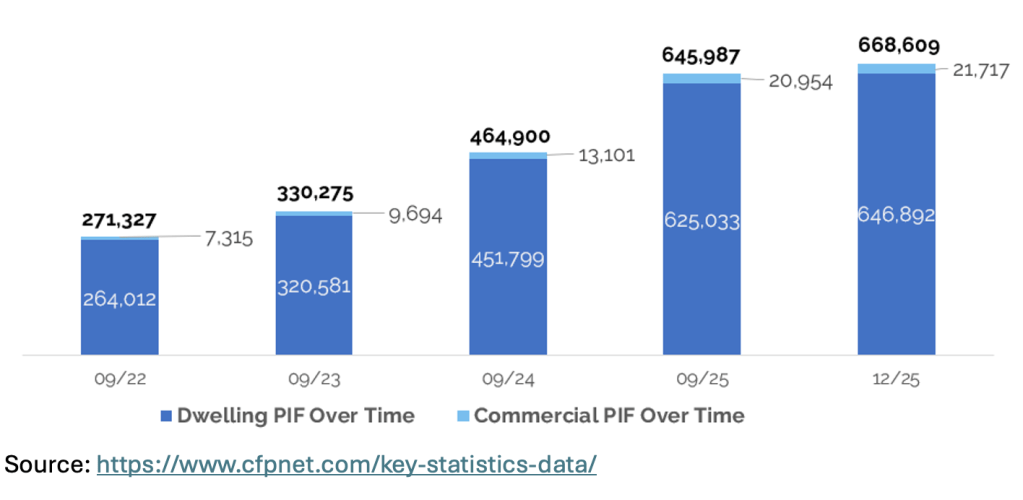

Sacramento, CA – The California FAIR Plan released new numbers showing enrollment continues to grow, adding 21,859 residential policies in the final three months of 2025. In contrast, six insurance companies that sought rate hikes under Insurance Commissioner Lara’s “Sustainable Insurance Strategy” have said they will sell 8,111 new policies in areas dubbed “distressed” over the next two years.

“The FAIR Plan added more policies in the last three months than the Commissioner’s strategy will add in the state in the next two years,” said Consumer Watchdog executive director Carmen Balber. “We’re still losing more coverage than we gain even as insurance companies use the new rules approved by Commissioner Lara to justify hundred-million dollar rate increases.”

FAIR Plan Total Dwelling & Commercial Policies In Force

The FAIR Plan’s high cost, low benefit policies, are a last resort for consumers who cannot find home insurance in the standard market. Its continued growth indicates the ongoing insurance crisis, said Consumer Watchdog.

One insurance company that never reduced its sales in California, Mercury, is responsible for a quarter of the promised new sales (2,107 policies). In fact, Mercury grew its business in California by over 40,000 policies since 2023. The Department of Insurance approved an $85 million, 6.9% home insurance rate increase for Mercury in December. CSAA also had a $75 million rate hike approved in December and did not have to commit to any new sales.

Four other insurance companies have promised 6,004 new policies in distressed areas in return for $280 million in rate hikes. The same four companies dropped more than three times as many policies – 20,510 – in distressed areas since 2023, and even more across the state. Those companies are USAA Group, Pacific Specialty, California Casualty and Farmers Group.

“Mercury got an $85 million rate hike in return for promising new sales it looks like the company was going to make anyways. Other insurance companies are seeking hundreds of millions more, but have already dropped three times as many policies over the last two years than they’ve said they’ll add in the next two. The Commissioner’s plan has not reversed the insurance crisis, it’s still getting worse. We need more, starting with a guarantee of coverage for fire-safe homes to get Californians insured again,” said Balber.

Reach out to Consumer Watchdog for a spreadsheet showing which insurance companies have said they’ll sell more policies, and how many they have dropped, under the Insurance Commissioner’s plan.

Lara’s September 2023 plan allowed insurance companies to raise rates in exchange for a purported commitment to insure 5% more people in so-called “distressed areas.” However, as a front page New York Times investigation found, loopholes in the plan allow companies to base any increase on a lower bar of current policy levels, after dumping hundreds of thousands of policyholders for the last two years to get their policy numbers down. In addition, the Times investigation found the way the maps of “distressed areas” were drawn often didn’t include high wildfire risk areas.