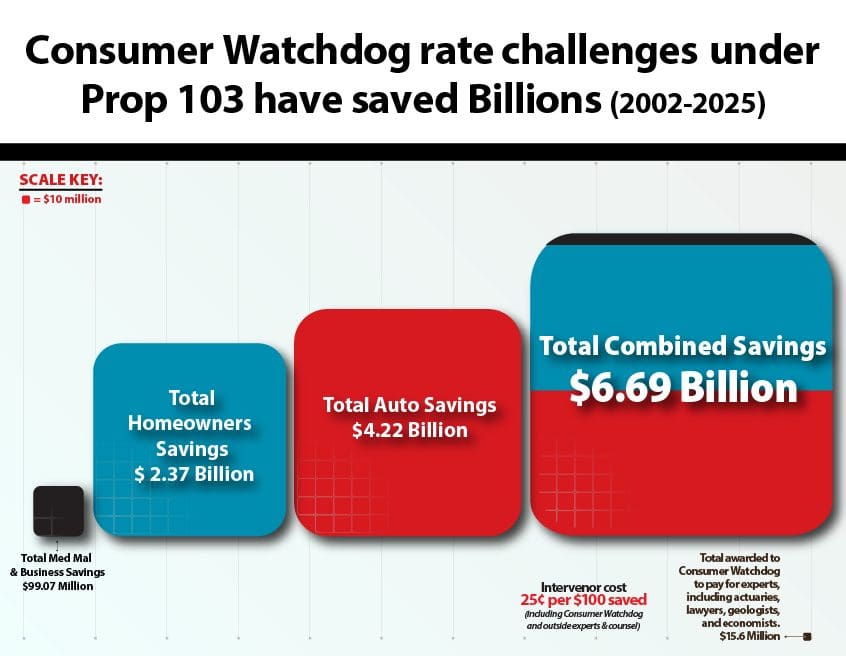

Los Angeles, CA – Responding to insurance industry criticism of the intervenor fees paid to Consumer Watchdog in 2025, the nonprofit Consumer Watchdog published this accounting of the savings from the rate hikes the group challenged as an intervenor.

Consumer Watchdog’s rate challenges in cases where fees were paid in 2025 saved consumers $2.35 billion. For these cases, the group’s in house actuary and attorneys were paid $1.11 million and its outside experts and counsel were paid $353,586 dollars — a cost of 6 cents for every $100 saved.

In addition, the intervenor fees paid in 2025 were for two dozen cases dating back to 2022 because the Department of Insurance delayed payment. Consumer Watchdog’s president Jamie Court said: “The intervenor process has the biggest bang for the buck of any consumer protection system in America. Policyholders saved $2.35 billion on their insurance bills and the attorneys and actuaries who stopped those unnecessary rates hikes were paid 6 cents for every $100 saved. Payments in many of these cases were unreasonably delayed for years. The insurance industry hates the process, which is why its attacks omit the savings to consumers in the rate cases.”