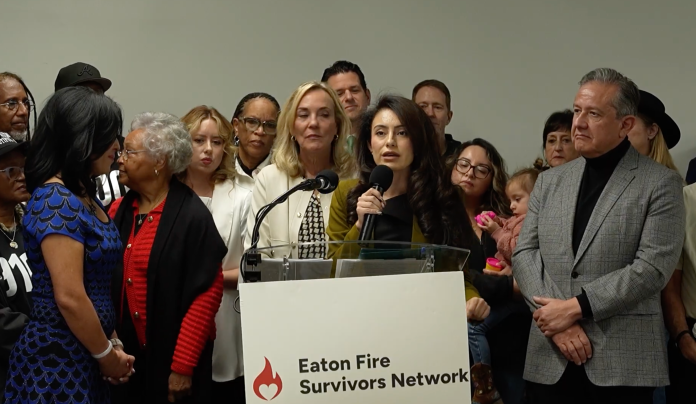

Los Angeles, CA – Consumer Watchdog and the Eaton Fire Survivors Network joined Senator Sasha Renée Pérez to announce legislation holding insurance companies accountable for insurance claim delays and alterations that deny survivors the insurance benefits they paid for.

“Insurance delays and denials are standing in the way of recovery. It’s time to make insurance companies meet their deadlines, be honest with survivors about what it will cost to recover, and hold them accountable when they fail to pay what they owe,” said Carmen Balber, executive director of Consumer Watchdog.

“Recovery accelerates when the money shows up. When it doesn’t, families are pushed out,” said Joy Chen, executive director of the Eaton Fire Survivors Network and a smoke damage survivor.

“So many Eaton Fire survivors have had their recoveries needlessly blocked by insurance companies with their long delays and questionable decisions/dealings. This can’t continue,” said Senator Pérez. “I am introducing two pieces of legislation— one that will penalize insurance companies that don’t meet their legal deadlines to make payments and a second that will force insurance companies to show their cards to policyholders when determining loss claim payment amounts. Real transparency and accountability will lead to a faster recovery,” said State Senator Sasha Renee Pérez.

Claire Thompson, a homeowner and small business owner, said her family paid insurance premiums for nearly a decade and was initially told their smoke-damaged home needed to be taken down to the studs, a determination that was later reversed. “The fire damage to my house did not change,” Thompson said. “But the loss estimate did, and it was reduced to an amount that made recovery impossible.”

SB 877 – the Fair Claims Practices and Transparency Act – requires transparency and accountability in loss estimate documentation so homeowners can clearly see how their payout was calculated, what changes were made, who made them, and why—allowing survivors to verify accuracy, challenge errors, and access the full benefits they paid for.

The insurance industry is notorious for altering, reducing and rewriting loss estimate and other claims documents before they reach consumers, enabling secret lowballing of claims that denies survivors a fair recovery. A CBS 60 Minutes investigation revealed systematic slashing of estimates, and a May 2025 U.S. Senate committee heard testimony from whistleblower adjusters describing estimate manipulation. A December 2025 San Francisco Chronicle investigation exposed the same practices are occurring in California in the wake of the Eaton and Pacific Palisades fires. The paper published internal insurer guidance instructing adjusters to route estimates through internal review layers that remotely reduce scope and cost and prioritize speed over accuracy.

SB 878 – the Insurance Payment Accountability Act – strengthens existing prompt-payment insurance laws by imposing interest penalties when insurers delay issuing payments and eliminating insurers’ incentive to stay silent on portions of a claim. California’s deadlines requiring insurers to respond to claims promptly and pay all undisputed amounts within 30 days are routinely evaded through open-ended reviews and partial decisions. The same San Francisco Chronicle investigation provided evidence that such delays are often driven by internal insurer adjuster guidance to avoid written decisions and prolong claims—effectively bypassing prompt-payment rules.