By Camille Von Kaenel, POLITICO

With help from Noah Baustin and Alex Nieves

FIRE SALE: The race for California insurance commissioner has gone from sleeper to slugfest.

Years of record-breaking wildfires have sparked a wave of insurance rate hikes and cancellations, hitting voters directly in their pocketbooks (opens in new tab) in a way that hasn’t been seen since the last wide-open race for the state’s top insurance regulator in 2018. The catastrophic Los Angeles fires that tore through one of the state’s political and fundraising power centers and are set to rise premiums across the state only further propelled property insurance from policy niche to kitchen-table crisis.

The result: An office most Californians probably couldn’t have named five years ago and that politicians viewed as a stepping stone (opens in new tab) to higher office has become a referendum on whether the state can make homeownership affordable in the age of megafires.

“It’s the most powerful job in the state for consumers,” said Jamie Court, president of Consumer Watchdog, which is pushing to expand consumer-friendly requirements on insurance companies but not weighing in on candidates. “It’s a place where you can make a huge impact — and make a name for yourself doing that.”

The heightened attention has drawn a more crowded field than in past races, with state Sen. Ben Allen, former state Sen. Steven Bradford, former San Francisco Supervisor Jane Kim and investment manager Patrick Wolff vying for the Democratic nomination, alongside Republican insurance agent Stacy Korsgaden.

Democratic strategist Orrin Evans called it “the most interesting of all the downballot constitutional races in California,” pointing to voter concern over affordability.

Ninety-two percent of likely voters said reducing insurance costs and increasing availability was important to them in a recent poll (opens in new tab) from California Environmental Voters and David Binder Research — ranking above water supply and data centers, and just behind electricity and gas prices.

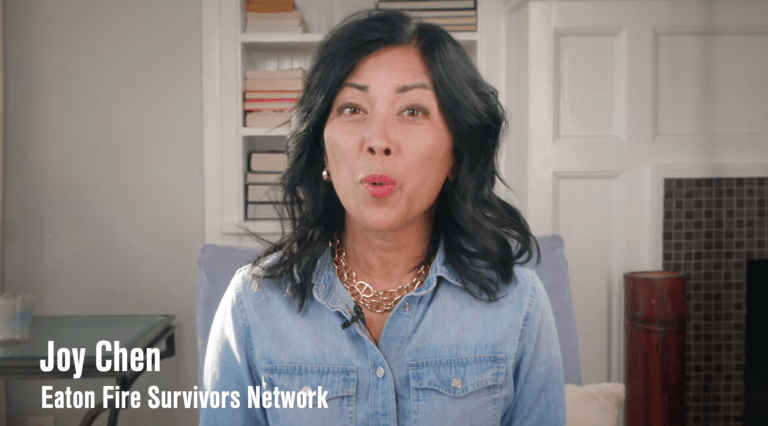

Sierra Lindsey Kos has seen the shift firsthand. As co-founder of Extreme Weather Survivors, a group advocating for disaster victims, she said insurance issues — particularly rates and the claims process, both directly overseen by the commissioner — have become an immediate post-disaster priority for the people she works with.

“You’d spend five minutes at an organizing event for any of the survivor groups we support, and you’d be hard pressed to find anyone who doesn’t know the commissioner’s name,” she said. “There is definitely more engagement. I mean, you’re seeing it even in my family text chain.”

Early internal polling from campaigns suggests Allen or Kim currently lead, though California’s top-two primary system leaves open multiple paths to November, including the possibility of an all-Democrat or all-Republican matchup.

The state Democratic convention next week could prove pivotal. A party endorsement would give a candidate more resources and publicity and has smoothed past Democrats’ path to victory, including former Insurance Commissioner Dave Jones in 2010.

Allen enters with the strongest money position, with over a million dollars already raised and a (still-empty) independent expenditure committee from Enviro Voters, though that still pales in comparison to the millions outgoing Insurance Commissioner Ricardo Lara raised for his run. Allen does already have a slate of legislative endorsements that could boost him with convention delegates. His pitch to voters revolves largely around his direct experience with wildfires, including the Palisades fire that tore through his western Los Angeles district, and his state legislative record striking practical consumer deals.

“I see the enormity of the problem here,” he said in an interview. “The moment calls for sustained focused bird dogging from the commissioner and really engaged conversations.”

Kim, meanwhile, is working to energize the party’s progressive wing and to frame the race as more than a fight over insurance rates. Channeling the economic populism of her former boss, Sen. Bernie Sanders (I-Vt.), she is arguing the office should be used to more confront corporate power and reshape how climate risk is financed.

“This office has been very under-leveraged, and it could be a powerful platform to put forward a bold agenda for working families and everyday people,” she said in an interview. She’s raised roughly $97,000 so far.

Bradford pivoted to the insurance commissioner race a few months ago from the lieutenant governor race. He brings the third-highest fundraising haul to the race from his experience as Senate Energy Committee chair at roughly $636,000. Wolff, who’s largely self-funding his campaign with a $600,000 loan, is bringing up his financial expertise and, as a chess grandmaster, is traveling around the state playing chess with voters.

Policywise, the Democrats are embracing similar measures, including getting more people off the basic last-resort FAIR Plan and encouraging wildfire-resistant home retrofits that could be linked to insurance coverage and lower premiums. Kim has also embraced the idea of state-backed disaster insurance ensuring coverage for all, which Court has criticized as a giveaway to insurance companies.

Korsgaden, meanwhile, is banking that voters want to see more insurers in the market. She’s promising to entice companies to stay and grow in the state by encouraging investment and new insurance products — a pitch that’s not out of the question even in deep-blue California, where Republican turnout has delivered the statewide office to the GOP as recently as 2006, when Steve Poizner won. She’s raised $83,000.

Hanging over the race is the turbulent tenure of Lara, who’s faced significant criticism (opens in new tab) from consumer advocates for accepting donations from insurance companies and rewriting the department’s rules to bring property insurers back to the state, even though he’s had Gov. Gavin Newsom’s backing (opens in new tab).

The blowback has been significant enough that the Democratic candidates have pledged not to accept money from the insurance industry — ensuring the industry’s main avenue for influence now runs through Republican donations or independent expenditures.

Already, Allen has had to return fraught donations (opens in new tab) from insurance companies leftover from past Senate campaigns, vowing that he is “committed to his pledge.” — CvK

Blake Jones contributed to this report.