By Ellen Snortland, LA DOWNTOWN NEWS

It’s hard for me to believe, but I’ve served on the board of the small yet mighty nonprofit Consumer Watchdog for 40 years. Before I get into my Consumer Watchdog (CW) journey, I need to say that it is a nightmare being a non-MAGA American right now. Marines in LA? Masked ICE goons kidnapping our brown sisters and brothers in broad daylight, following orders issued by the Thug in Chief? A bill that cuts Medicaid so severely that the most vulnerable among us will die? And all of it fueled by unabashed greed to benefit our oligarchs. The Despair List is too long even to fathom, which gives context to why CW is so important to me.

CW president Jamie Court invited me to go on stage for the 40th Anniversary Awards dinner to kick off the evening. He asked me to introduce a 40-year retrospective of CW’s accomplishments and to share my experiences as a wildfire survivor. Here’s an adapted version of my speech, which encapsulates why I’ve cared enough to persist for four decades:

When CW founder and father of Prop 103, Harvey Rosenfield, first asked me to join the board, I was honored and gladly accepted. At that time, there weren’t many women on boards. Harvey’s wife and my best friend from college, Georgia Bragg, recommended that I serve. I realized that being on the board would suit me personally, emotionally, and professionally — and as a tribute to my late father, Arnold M. Snortland.

My father was a leader of the Farmers Union in North Dakota. The mostly Norwegian American farmers there valued cooperatives. Instead of seven farmers each buying their own pair of draft horses, they shared two horses and used them for plowing, hauling rocks, and pulling one-horse open sleighs in wicked blizzards. (Shades of “Jingle Bells.”) The co-ops also shared farming equipment, helped each other during harvests, and the farmers even pooled their resources to buy insurance from the Farmers Union and Farmers Co-op. If one farmer faced a disaster, the shared insurance could save them from catastrophe or enable them to buy a new pair of Percherons.

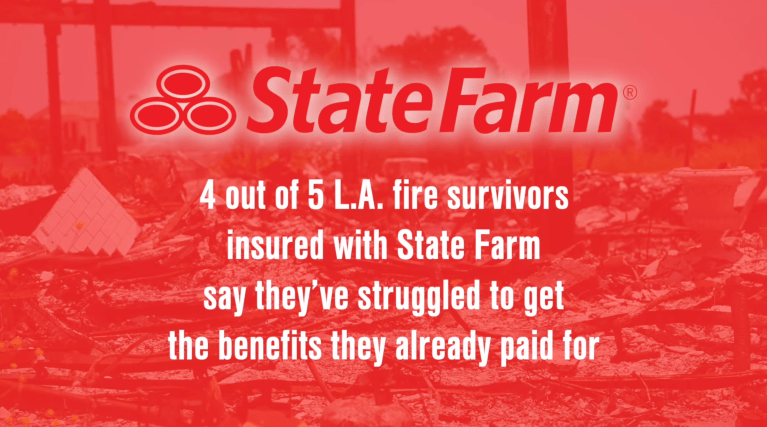

Compare and contrast with modern-day for-profit insurance companies like State Farm and Farmers. Both started in the 1920s, focusing on rural policyholders and offering affordable policies, especially during the Great Depression. Shame on them for forgetting their roots and doing whatever they can to shaft claimants now.

My father eventually ran his own insurance company, which offered prompt and fair payouts on claims. The company’s income eventually paid for my law degree from Loyola Law School. My dad was the only executive I ever heard of who refused a raise, saying, “I have what we need for my family, so no thanks.” Who does that?

When I moved to California from the Dakotas, I was shocked to discover that insurance companies often refused coverage based on ZIP codes or denied legitimate claims. It was disgusting to see how late-stage capitalism had turned people’s catastrophes into opportunities for executives and shareholders to get richer, while loyal policyholders were left holding the bag. Scandinavians are capitalists, but they are socially minded and don’t believe in letting people suffer for profit.

This brings me to my current state of suffering. My husband and I lost our Altadena house and all its contents in the Eaton Fire. It’s truly shocking to have to start over with our lives in our 70s.

Soon after we were married 18 years ago, Ken spoke with our Farmers agent to review our homeowners policy. The agent said, “I think you may be overdoing it.” Ha! Ken and I had both previously lost our homes to natural disasters in the 1970s (note to self: Don’t ever live with us!), so the good insurance news is that Ken definitely “overdid” it… Thank goodness.

The bad insurance news? Farmers, like every other insurer in this state, want us to create a thorough inventory of our personal belongings. That means mentally going room by room, cabinet by cabinet, drawer by drawer, recalling every single item we ever owned that burned up and listing them on a spreadsheet before they issue a final check. That’s just flat-out cruel.

California Senate Bill 495 — the “Eliminate The List” bill — is strongly supported by Consumer Watchdog and would eliminate that requirement. It’s bad enough that we and our fellow survivors are still traumatized daily by losing our precious town and decades of treasured possessions. Having to write down replacement values for thousands of irreplaceable items only intensifies the pain.

I am proud and grateful to be part of a small and mighty group of advocates dedicated to righting the wrongs of utility, oil, and insurance companies. Thanks for the opportunity to wake up each morning to, as Harvey says, “See how we can kick the bad guys where it hurts, today.”

If you’re interested in my online creative writing class, email me at [email protected]. Many of you have asked if there is a GoFundMe campaign to help us recover from the devastating loss of our home and possessions. The answer is yes! You can donate at bit.ly/Ellen-Ken.