Thursday's reports that some Californians will get rebates on their health insurance premiums are a little bit of good news–but not nearly as good as it could be.

Thursday's reports that some Californians will get rebates on their health insurance premiums are a little bit of good news–but not nearly as good as it could be.

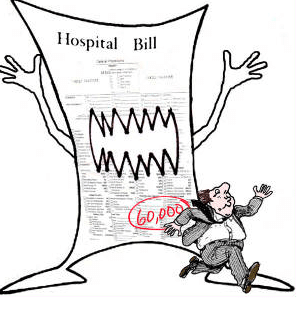

An L.A. Times story reports that California small businesses and their employees who are insured by United Health Group will get rebates averaging $98 on last year's premiums because United Health didn't spend at least 80% of the premiums on health care, a requirement under the federal health reform. The total will come to about $3.5 million in the state. Other insurers may also owe money on small business, large employer and individual policies–the figures are still being crunched.

But what if insurance companies could not overcharge us in the first place? The 80% rule in the federal law only encourages insurance companies to pay hospitals and doctors inflated prices, because it inflates the 20% that insurance companies get to keep. (It's like the Hollywood agent who gets a 15% cut–his personal incentive is to get the biggest price for his client.) With no real curbs in California on how much insurance companies can charge, they have no incentive to bargain for lower medical costs to begin with.

Unlike 35 other states, California has no power to make health insurance companies justify their rates and to deny or modify unreasonable or unjustified rates before they go into effect. Californians also have no right to make the state do its job through consumer challenges to unjustified rates. All this would change if voters pass an initiative, sponsored by the Consumer Watchdog Campaign, that's headed for the November ballot.

Which brings us to another huge source of savings–the inflated rates that insurance companies encourage hospitals and in some cases doctors to charge. A shocking recent story, also in the L.A. Times, found that patients who are insured are often paying out of pocket many times the amount of patients who pay cash for the same treatment.

Here, from the story, is how it works:

Here, from the story, is how it works:

Many hospitals, doctors offer cash discount for medical bills

The lowest price is usually available only if patients don't use their health insurance. In one case, blood tests that cost an insured patient $415 would have been $95 in cash.

May 27, 2012|By Chad Terhune

A Long Beach hospital charged Jo Ann Snyder $6,707 for a CT scan of her abdomen and pelvis after colon surgery. But because she had health insurance with Blue Shield of California, her share was much less: $2,336.

Then Snyder tripped across one of the little-known secrets of healthcare: If she hadn't used her insurance, her bill would have been even lower, just $1,054.

"I couldn't believe it," said Snyder, a 57-year-old hair salon manager. "I was really upset that I got charged so much and Blue Shield allowed that. You expect them to work harder for you and negotiate a better deal."Unknown to most consumers, many hospitals and physicians offer steep discounts for cash-paying patients regardless of income. But there's a catch: Typically you can get the lowest price only if you don't use your health insurance.

That disparity in pricing is coming under fire from people like Snyder, who say it's unfair for patients who pay hefty insurance premiums and deductibles to be penalized with higher rates for treatment.

The difference in price can be stunning. Los Alamitos Medical Center, for instance, lists a CT scan of the abdomen on a state website for $4,423. Blue Shield says its negotiated rate at the hospital is about $2,400.

When The Times called for a cash price, the hospital said it was $250.

Is your blood boiling yet? Insured patients can try to pay the cash price, but elsewhere in the story we find that hospitals may not even allow patients with insurance to get the cash price. And if you pay cash, it doesn't count against your deductible or the out-of-pocket limit for your policy. Is this cozy or what for the (usually for-profit) insurance companies and (often for-profit) hospitals?

If California had the power to approve, deny or modify unjustified health insurance rates before they went into effect, the insurance companies would have to do more than prove they're spending 80% of your premium on whatever they can define as "health care." With their books open and both consumers and regulators looking on, they'd have powerful incentives to push harder to bring down costs, just as auto insurance companies do—in large part because regulators are watching. Executive compensation in the millions would no longer come out of patients' pockets.

That form of regulation, called "prior approval" of rates, is the aim of the ballot initiative sponsored by the Consumer Watchdog Campaign. The same kind of regulation, passed by voters as Proposition 103 in 1988, already saves hundreds of millions of dollars a year on average for auto and homeowner insurance buyers in the state. In just the first nine years after voters passed Prop 103 in 1988, property and casualty insurance companies had to fork over more than $1 billion in consumer rebates–similar in type to the $3.5 million United Health is paying.

It's no surprise that the health industry is one of the state's most powerful political lobbies. It's no surprise that such lobbying power has killed every effort to pass effective control of health insurance rates in the Legislature. It's also no surprise that stories like the one above are making voters furious. At least voters, unlike too many politicians, don't have to do what the health insurance industry tells them to do.