Everyone knows health insurance costs are rising rapidly, but a new study mreveals just how heavy a toll that takes on businesses, families and single people.

Everyone knows health insurance costs are rising rapidly, but a new study mreveals just how heavy a toll that takes on businesses, families and single people.

The numbers are sobering, and they are one reason why wages have stagnated,

experts say.

From 2003 to 2010, the combined average amount that California families and their employers paid for health coverage shot up 52 percent, reaching $13,819 annually, according to a recently released study by the Commonwealth Fund.

And what happened to family income during that time?

It rose a mere 4 percent.

Single people didn't fare any better.

Their premiums soared 46 percent, to $4,811, while their incomes remained flat.

Companies still pay the bulk of such costs but are increasingly telling employees to shoulder a bigger share.

Many employees also are finding they suddenly have new co-pays, higher deductibles and other cutbacks in health benefits as firms struggle to control costs.

Adding to the aggravation for workers: The rising premiums are stifling wages.

"If you think of the whole compensation package, and if one part of that is going up as quickly as it is, then your wages are going to go up at a slower rate," said study co-author Sara Collins, a vice president of the Commonwealth Fund.

'A money pit'

Over the years, the premium numbers really add up, the study shows. From 2003 to 2010, the total amount paid by the average firm and an employee for family health coverage exceeded $63,000 — enough to pay for a new BMW or finance a UC Berkeley student for two years.

The average company and a single person paid more than $23,000 for premiums during those seven years, enough to rent a 16-passenger yacht to tour the Galápagos Islands for five days.

"It's eating into our raises substantially, which hurts the economy because I can't do as much shopping as I would," said Aaron Aragon, a shop steward for Local 853 of the San Leandro Teamsters. "It's just been terrible the last 10 years."

Aragon works in shipping and receiving for a major retailer. In contract talks three years ago, his union gave up raises in favor of lowering employees' cost for health coverage.

Today, he makes $704 a week, the same amount he did three years ago, and he pays $90 weekly as his share of premiums.

"From the employers' standpoint, their profits don't go up 10 percent to 15 percent a year like the health insurance companies charge," Aragon said. "From the union's standpoint, we can't make any improvements in our employees' lives. It's a money pit. It's just a sinkhole."

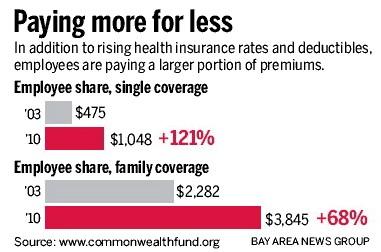

Premiums may be rising rapidly, but the employees' share is climbing even faster, the study reveals. Many firms are shifting more of the expense to workers.

The result: While wages stagnated, the amount paid by the average working family for its share of health premiums jumped 68 percent, from $2,282 annually in 2003 to $3,845 in 2010.

It more than doubled for single people, rising to $1,048 in 2010.

"Families are not only paying more for their premiums, they're actually getting less value in their benefit plan because their deductibles have gone up so much," Collins said.

The average individual in California had a $1,051 deductible in 2010, more than double the $517 he or she paid in 2003.

Employees at small firms have been hit especially hard, with an average deductible of $1,484 last year, compared with $920 for employees of large firms.

When Colleen Callahan, an independent insurance agent in Lafayette, started out 20 years ago, a $250 deductible was unusual. Now, she said, she hears about deductibles of $2,500, $3,500 and higher.

Castro Valley resident Michael Spurek, a 59-year-old Postal Service mail handler, was disturbed when Anthem Blue Cross in September told him it would not participate in the Federal Employees Health Benefits Program in 2012 and he would have to choose another plan during open enrollment.

His share of his premiums had been $68.25 every two weeks. But he discovered that with other HMO plans available next year, his biweekly expense would soar to $202 to $222.

Unable to afford that, he opted for a PPO plan that will cost him $64.95 biweekly, but it will also have a $350 deductible and new co-pays for office visits, hospital stays and prescription drugs. He also will pay more if he sees doctors outside of the PPO network.

"My monthly deductions are about the same, but if I use the services, then my out-of-pocket expenses will significantly increase," he said.

"So I'll try not to use the services, but that's a hell of a position to be in because then I'm paying for services that I really don't want to use.

"The whole health care system is a mess, and it needs someone smarter than me to figure it out," he said.

Push for regulation

Debate over rising premiums is expected to intensify in California next year if Consumer Watchdog succeeds in giving voters a chance to weigh in on rate regulation.

The group hopes to put an initiative on the November ballot that would give California regulators more power to restrict health insurance rate hikes.

"The public keeps seeing premium increases, and no one knows whether they're justified and no one can say 'no,' " said Consumer Watchdog President Jamie Court.

"The government in 2014 is going to require everyone to have proof of health insurance and yet there's no transparency or accountability for the prices health insurance companies charge," he added. "It's a travesty."

The insurance industry and other groups are expected to strongly oppose the measure.

"Health insurance has substantial regulation now at the state and federal level," said Patrick Johnston, president and CEO of the California Association of Health Plans. "Adding more regulation won't address the cost-drivers to health care."

Johnston attributes premium increases to the hefty price of sophisticated medical equipment, higher drug costs, and an aging population that lives longer and needs more care for chronic illnesses.

He also notes that inadequate funding of Medicaid and Medicare, combined with record numbers of uninsured people because of the faltering economy, causes hospitals and doctors to shift costs to those with private insurance. Some estimates say the shift adds $1,792 annually to the premium of each insured California family.

And people are using more services, Johnston said. His organization notes that from 2000 to 2004, knee replacements increased 53 percent and hip replacements rose 37 percent. Costly CT scans in emergency rooms grew from 2.7 million per year in 1995 to 16.2 million in 2007.

"Health insurance premiums are a direct reflection of the cost of medical care, and so as the cost of care continues to rise, premiums rise in turn," Johnston said.

Insurer revenue

The national health reform law has provisions to slow escalating costs, including one that could bring rebates to many customers beginning next year. Rebates would be required from insurers that spend more than 15 or 20 percent of their premium revenue on administration and profits.

Collins said that next year, as many as 9 million people throughout the nation may be eligible for rebates that could be worth as much as $1.4 billion, according to some estimates.

One insurer has already issued rebates. The not-for-profit Blue Shield of California announced in June that it would limit its net income to 2 percent of revenue. Since then, it has handed its customers millions of dollars in credits on premiums.

Contact Sandy Kleffman at 925-943-8249.