Monday’s jump in oil prices to more than $108 a barrel, with the price of gasoline above $3.66 a gallon for regular ($4.06 in California), triggered a flood of news stories. But the dry, just-the-facts lead of the Bloomberg story caught my eye because one prediction driving speculation will crumble if the speculators win:

Monday’s jump in oil prices to more than $108 a barrel, with the price of gasoline above $3.66 a gallon for regular ($4.06 in California), triggered a flood of news stories. But the dry, just-the-facts lead of the Bloomberg story caught my eye because one prediction driving speculation will crumble if the speculators win:

Crude oil, gasoline and heating oil extended their gains to the highest levels since 2008 on speculation that conflict in Libya and Middle East unrest will curtail fuel supplies and that a strengthening U.S. economy will boost demand.

It’s good to see that no one is bothering to call it anything but speculation, since the U.S. buys almost no oil from Libya. And crude oil stocks in the U.S. have been rising for weeks (as of the March 25 federal report), which would make prices fall if supply and demand had anything to do with it. But if the speculators keep driving up the price, there will be no “strengthening U.S. economy” (or consumers with money) to drive up actual, rather than hoped-for, demand.

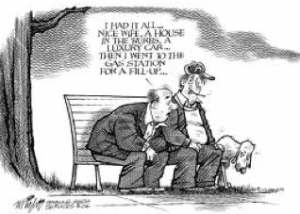

Economists look at oil over $100 a barrel, and gasoline hitting $4.00, as the points where the economy can absorb only months of such punishment–and less if conditions are fragile. The speculators are killing the goose that laid their golden egg–but unlike in the fable, they will have walked off with their profits before the goose gives its last cackle.

There are plenty of effective proposals for putting a leash on the most damaging speculation, but the agency that is supposed to write the rules is paralyzed by lobbyists from the financial industry.

The chairman of the Commodity Futures Trading Commission, for instance, announced last week that speculation rules that are already overdue won’t be done until at least midsummer, because of the the more than 5,000 public comments the CFTC received. There is no doubt that 90% or more of those comments are from financial companies, hedge funds and other homes for speculators, all of them predicting the sky will fall on financial markets if they have to play by any effective rules. It’s a Chicken Little strategy, and industry money means a lot of politicians and federal agencies act like they believe such threats.

One letter, however, was from Sen. Carl Levin of Michigan, who accurately predicts on whom the sky will actually fall if the speculators win. From wsj.com:

“Until this proposed rule is adopted and effective position limits are put in place, the American economy will continue to be vulnerable to excessive speculation and the violent price swings it can cause.”

So the economy can recover enough to boost demand for energy products, including gasoline. Or speculators can keep driving up the price to $150 a barrel, as happened in 2008. And we all remember how the economy reacted then.

Consumer advocates obviously can’t spend like the lobbyists. But a few groups, including Americans for Financial Reform, have the expertise and enough money to monitor what’s going on. They have a mailing list, and OilWatchdog’s parent, Consumer Watchdog, is part of their coalition. You can add another voice breaking through the lobbyist din.